How to create a financial report: Track performance and make decisions

Tempo Team

Whether buying furniture for the office or investing in hardware modernization, upper management always includes financial considerations in their decision-making process. Understanding where revenue comes from, where it goes, and how much is in reserve allows businesses to make smart, objective choices about how to spend the company’s money.

Investors also rely on these reports to provide a glimpse into a company’s viability, which may determine if they want to buy or sell their shares. Financial reporting is the basis for understanding a business's vitals – their profits, cash flow, and assets – during a quarter or fiscal year.

This guide will explore the finer points of financial reporting and showcase how Tempo’s tools streamline your cost analysis.

What are financial reports?

A financial report is a document that aggregates data on corporate profits and losses. The information within helps leadership understand revenue, costs, debts, and equity changes, highlighting areas of strong or weak performance within every level of their operation.

Typically, a comptroller is responsible for preparing fiscal summaries following financial reporting standards like Generally Accepted Accounting Principles (GAAP) for companies operating in the United States. Global or multinational organizations adhere to the International Financial Reporting Standards (IFRS). Regardless of the chosen standard, these frameworks ensure that the company’s financial statements follow a consistent format and provide a clear and accessible picture of its fiscal status.

Importance of financial reports

A company’s financial status impacts multiple areas of concern, not just internal decision-making.

Strategy and goals

Corporate leadership uses financial reports primarily to inform decisions regarding growth, costs, and operational investments. These statements provide the insight necessary to prioritize projects to meet short and long-term goals.

Budgets and forecasts

Historical financial data showcases trends managers can use to create more accurate revenue and growth forecasts. They can see where the company generates and disburses funds, allowing them to establish realistic budgets, plan for future costs, and capitalize on new opportunities.

Transparency and compliance

Accurate financial reporting guarantees that investors, creditors, and the public remain up-to-date on company performance. Financial transparency maintains accountability, ensures compliance with legal and ethical standards, and ultimately builds stakeholder and auditor trust in corporate stewardship.

Investment and valuation

Financial reports aren’t only used to track profit and loss for internal stakeholders. These documents assist potential investors in evaluating the possible risks and returns of purchasing a stake in the company. A glowing account of corporate finances is a powerful tool to secure new investment sources.

Banking and creditors

Banks require corporate loan and credit applicants to provide financial statements outlining revenue. A favorable financial report also helps businesses procure preferential borrowing conditions or interest rates and secure additional lines of credit to help them through lean periods.

Team performance and productivity

Comparisons of current and historical fiscal data allow company leadership and departmental management to assess operational performance, identify trends, and address areas of weakness, promoting individual or organizational improvement. If your finances are on the upswing, it usually means your team is working together well.

Time

Audits are notoriously time-consuming. Should the IRS, government accountability office, or regulatory agency require a review of the company’s financial statements, having complete and accurate records speeds up the auditing process and takes the stress off.

4 common types of financial reports

Financial reports come in many different formats, and a comptroller may draft them as a standalone disclosure or include them in the company’s annual investor brief. The four more common types are as follows.

1. Balance sheet

The corporate balance sheet assesses the company’s current financial vitals, including:

Assets: Cash, investments, property, inventory, accounts receivable.

Liabilities: Accounts payable, salaries, taxes, accrued expenses, long-term debt.

Equity: Common stock, preferred stock, retained earnings, paid-in capital.

Rather than predicting future trends, this financial statement provides a real-time overview of the business’s liquidity, solvency, and net worth. The data equips upper management or investors to gauge overall corporate health and make informed financial decisions.

2. Income statement

Sometimes called a profit and loss statement, the income statement provides insight into the entity’s revenue and expenses, allowing leadership to determine the company’s profitability over the last quarter or fiscal year.

Income statements typically include five key components:

Revenue: The total income generated from the sale of goods and services.

Cost of goods sold (COGS): The total cost of production.

Gross profit: The difference between revenue and COGS.

Operating expenses: The amount it costs the company to operate, including salaries, rent, and utilities.

Net income: The amount remaining after subtracting operating expenses and taxes from the gross profit.

3. Cash flow statement

While the income statement identifies areas of profit and loss, the cash flow statement enumerates the movement of funds into and out of the company’s accounts, illustrating where the money comes from, how management uses it, and whether there’s enough to sustain ongoing operations.

Cash flow statements can be into three main categories:

Operating activities: The funds spent or earned from daily business operations.

Investing activities: The investment value generated from earnings or spending.

Financing activities: The amount generated or disbursed in the service of loans, debt repayment, or stock offerings.

4. Statement of shareholder equity

Although they’re typically included as part of the balance sheet, larger corporations may issue a statement of shareholder equity separately if it’s extensive enough. The equity statement reports on:

How much company stock and securities are held by company owners and key stakeholders, plus total dividends paid per quarter or fiscal year.

The total sale value of common or preferred stocks.

The total treasury stock purchases during the reporting period minus reissued treasuries.

The total income generated by unrealized capital gains after deduction of capital losses.

This information allows shareholders to gauge the organization's standing by analyzing the evolution of the ownership structure and summarizing corporate worth.

Should accounting choose to compile several financial statements into a single consolidated financial statement or add them to the annual report, they may decide to include other reports and documentation as appendices, including:

Budget versus actual analysis, which provides a comparison of the company’s planned spending against its actual results.

Notes to the financial statement, which provides context and insight into risk management practices, compliance with accounting standards, and details of individual line items, among other information.

Management’s discussion and analysis (MD&A), which provides an executive level view on factors affecting business outcomes, including market conditions, financial commitments, and performance projections for the coming term.

How to create a financial report

Whether you’re a federal employee drafting a statement for your department's annual report or a startup’s accountant pulling together a disclosure for potential investors, financial reporting follows a similar process.

Gather and reconcile data

Begin by gathering and organizing all pertinent financial information for the reporting period. Depending on the type of statement, this could include:

Sales invoices

Purchase orders

Expense receipts

Bank statements

Payroll records

Using supporting documentation, verify accuracy by reconciling this data against the opening and closing values of asset, liability, and equity accounts.

Select reporting standards

Considering the audience and regulatory requirements, determine whether to draft the statements using the GAAP, IFRS, or other accounting standards. This will largely depend on where the business analyzed in the report was incorporated.

Prepare core statements

Use the financial data to draft the four core financial statements: cash flow statement, statement of shareholder equity, income statement, and balance sheet. You may also want to attach notes to the financial statement, a sustainability analysis, or a report from the CEO.

Draft the MD&A

Use the MD&A to provide an overview of the company’s fiscal performance. Conclude with a discussion about current corporate positioning, liquidity and capital resources, and operational profitability. To ensure that the MD&A is accessible to the general public, not just senior management and investors, avoid jargon and overly technical language.

Review

Double-check the accuracy of your reporting plus compliance with regulatory requirements and accounting standards. If available, request another member of the team to review the statement for errors or inconsistencies in the data or calculations.

Create presentation

Finally, compile your findings into a readable format supplemented by visuals like tables, charts, and graphs to help visualize the data. Use page numbers and headings to help guide the reader. Before your presentation, print out copies of the financial statement to facilitate note-taking and questions.

In some cases, accounting practices may require publishing a press release summarizing the financial statement to financial news outlets, such asEuromonitor or Google Finance.

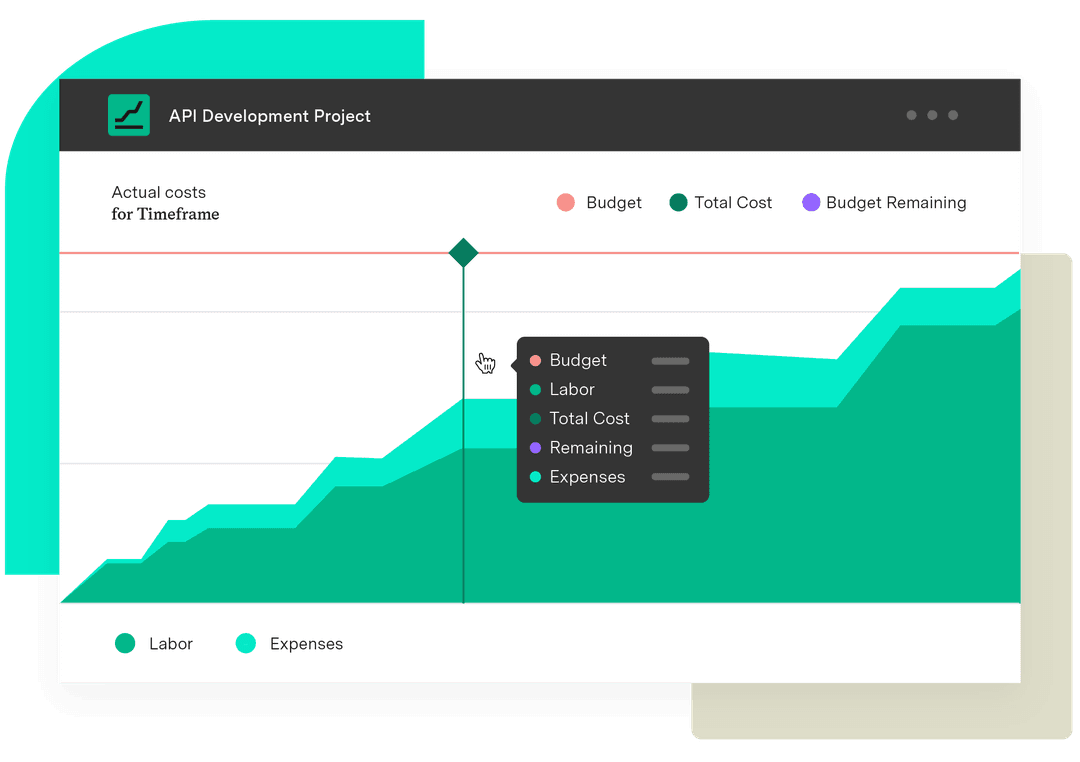

Improve financial visibility and reporting with Tempo

Drafting accurate financial statements without real-time data can be labor-intensive and frustrating. Let Tempo streamline financial tracking across project portfolios with our powerful Financial Manager and Timesheets applications.

Timesheets uses AI to effortlessly track billable hours and expenses across multiple projects, creating customized spending reports. Financial Manager monitors budgets and costs, allowing you to control spending and meet established fiscal targets.

Try Tempo’s Jira-native tools today, and make drafting financial reports a breeze.