Shape your business’s future with financial forecasting

Tempo Team

Sometimes, sheer luck plays a role in enterprise success. But it’s not the sole determining factor impacting your organization’s performance. It’s critical to look ahead and anticipate changing circumstances to support your company’s growth and goal achievement. Financial forecasting is one method of proactive assessment. It removes significant uncertainty from capital investment, project planning, and budgeting decisions by analyzing historical data and current market trends to predict the most likely outcomes for the business.

Any company can benefit from a financial forecast, no matter its size or developmental phase. Consistent, data-driven financial planning and forecasting are essential to scaling quickly, predicting future performance, and ensuring the organization maintains a solid financial position within the marketplace. Projections also play a role in reducing cash flow disruptions, inventory shortfalls, and decreased business valuation.

What’s financial forecasting?

Financial forecasting involves assessing past business performance, current business trends, and other relevant factors from internal and external sources to predict a company’s trajectory for the upcoming year or quarter. Cross-functional teams generate forecasts using qualitative analysis when there’s a lack of historical data. Alternatively, when historical context is available, they use quantitative techniques like straight line, moving average, and simple or multiple linear regression analysis. Forecasts inform decisions regarding purchasing, hiring, capital expenditures, and more.

Financial forecasts are also routinely included with balance sheets, cash flow, and income statements as part of the pro forma financial statement delivered to investors or creditors when the company seeks additional funding or to show the projected impact of an acquisition or merger.

A financial forecast should not be confused with a financial model. A forecast projects a business’s performance over an established period. Drawing on the results of a financial forecast, financial modeling uses the generated data to simulate various situations and predict the possible impacts of these scenarios on the company.

The importance of financial forecasting

Financial forecasts form the basis of every company expenditure decision over a quarter or year. Once established, a robust financial projection practice routinely leads to better economic outcomes, a predictable cash flow statement, and favorable access to credit and investments when it’s time to fund company growth.

Here are some additional ways financial forecasts benefit companies.

1. Inform budgeting decisions

Forecasting is the first step in developing a financial plan. It uses historical data and current trends to predict the future state of the business while considering unknown factors like market changes. After analyzing the forecast, department heads can estimate and set team budgets for the upcoming period.

2. Establish accountability

A financial forecast helps set budgets, and budgets establish benchmarks to evaluate progress toward long-term financial goals. This ensures those in charge of spending actively manage their finances to keep disbursements within expected levels.

3. Cultivate evidence-based decision-making

Forecasting offers stakeholders the accurate data necessary to make informed and realistic decisions regarding organizational and product strategy and investments. It considers the company’s present state and its modeled future potential to guide financial plans and adjustments.

4. Improve risk assessments

Financial forecasting involves identifying risks, developing the means to mitigate them, and establishing additional contingencies. By encouraging imaginative scenario-building, businesses can reduce liability and improve the recovery rate from unforeseen financial events or other calamities.

5. Foster a planned, continual growth rate

Using reliable data and well-grounded assumptions to inform the forecast can uncover insights into business processes that can lead to improvements, innovations, and growth opportunities. This information and how you use it can drive sustained and increased revenue generation.

6. Increase efficiency

Analyzing potential business scenarios offers insight into provisions and contingencies the company can add to its operational processes, ensuring they operate smoothly regardless of circumstance.

The difference between a budget and a forecast

In accounting, budgeting and forecasting are two very different financial statements. Generally, a forecast estimates financial results, while budgets define a company’s quantifiable expectations about its financial goals. Other differences include:

Details: A forecast generally limits itself to significant operational revenue and expenses, sometimes including projected cash flow but no other financial details. Budgets, on the other hand, offer a detailed representation of a company’s goals for future results, financial position, and cash flow over a specific period.

Updates: Budgets generally update once a year, although upper management can revise them more frequently should the circumstances warrant. Forecasts adjust at regular intervals — monthly, quarterly, or annually.

Variance: To ensure the company is on steady financial footing, teams compare budgets to outcomes to identify any variances in the plan. With projections, management engages in no such variance analysis to compare the accuracy of forecasted results against the actual.

Considerations: Should the variance analysis uncover significant deviations from the budget, senior management will step in to remediate the situation for the rest of the period. Forecasts are a short-term operational consideration, establishing staffing, inventory, and production plans for the term, but they don’t require intervention.

Impact: Unlike budgetary comparisons that can trigger a bonus, forecast adjustments don’t impact performance-based employee compensation.

8 key financial forecasting components

Financial forecasting is a prediction based on conditions subject to change at any time, making projections seem unreliable. But undertaking a thorough information-gathering process and including as many independent variables as feasible can improve the accuracy of your assumptions, building confidence in your results. Fully accounting for these factors can mean the difference between succumbing to or overcoming unforeseen events.

To generate a rigorous financial forecast, managers must consider the following components.

1. Historical data weighed against current conditions

Weigh prior performance against current circumstances to determine how much influence a data segment has over the rest of the forecast. For example, financial forecasts for industries impacted by the pandemic should consider their sales figures for that period differently than historical information from prior and post-COVID years.

2. A focus on the future

Establish a standard projection period of 12, 18, or 24 months for your financial forecast, or undertake a rolling forecast schedule to maintain flexibility in response to a volatile economic environment.

3. Macroeconomic risks

Don’t get caught off guard. Consider major global events such as natural disasters or an economic crash that can severely impact your bottom line.

4. Best-case revenue scenario

Not everything is going to go wrong. Be optimistic and consider the outcome should each product and service perform according to plan.

5. Worst-case revenue scenario

Scenario planning methodologies can help you forecast the outcome should the organization face a crisis that wipes out its revenue stream.

6. Expected expenses

Rent, shipping, insurance, and other business expenses rarely remain static from year to year. Consider and analyze the projected increases in these variable costs as part of your forecast.

7. Catastrophic unanticipated costs

Calculate the projected cost to your company if you need to recover from a devastating cyberattack, fire, or natural disaster.

8. Internal risks

Include risk-adjusted forecasting to avoid blind spots when identifying internal hazards like executive-level fraud.

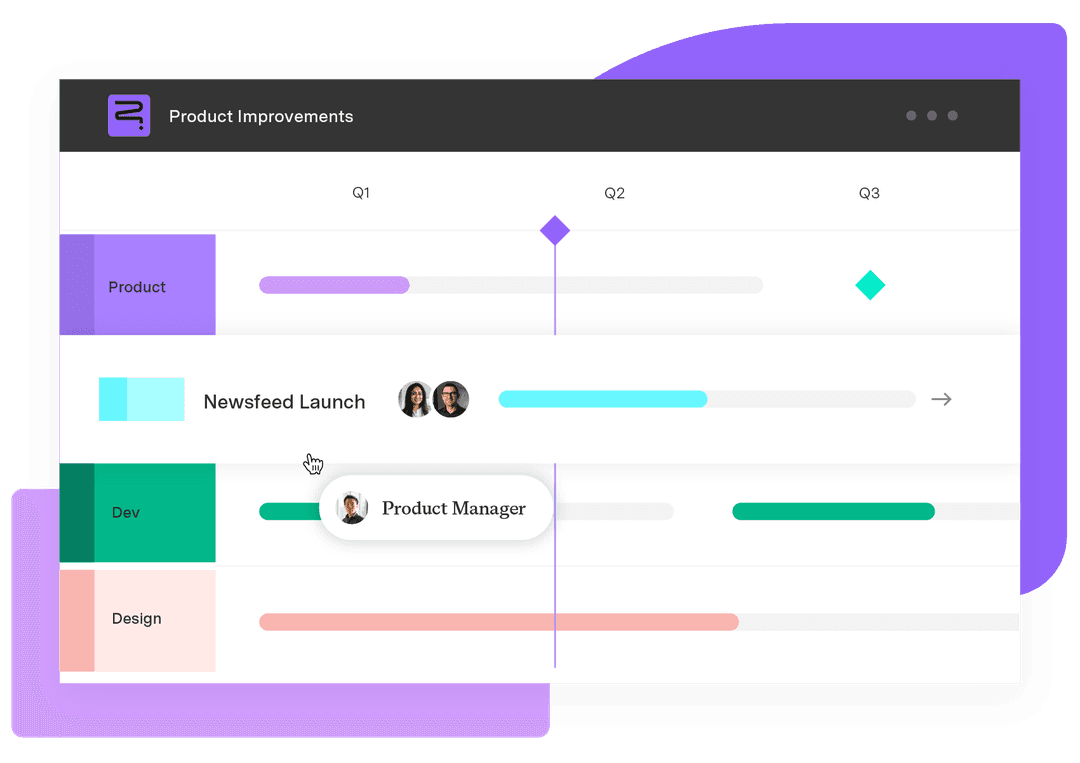

Bringing clarity to financial futures with Strategic Roadmaps by Tempo

With so many independent and dependent variables to consider, monitoring financial health for every level of an organization is no easy task. Centralizing this data into a single accessible location using Tempo’s Cost Tracker software will streamline your financial reporting process, simplifying and accelerating projection generation. You can also try new forecasting capabilities in Planner by Tempo to anticipate project outcomes.

Based on your forecasts, schedule your portfolio of projects with LiquidPlanner. You can also create and share product roadmaps with stakeholders using Strategic Roadmaps to demonstrate how these initiatives will support and align with your projected financial goals.