Variable expenses: What they are and how to track them

Tempo Team

Managing corporate spending starts with knowing exactly where the money goes. But to budget, forecast, and plan effectively, you need to understand what kind of expense you’re dealing with.

One common way to categorize costs is by separating them into fixed expenses and variable expenses. Companies do this to make smarter decisions about pricing, production, and resource allocation, and that ultimately helps them meet their financial goals.

Here’s what you need to know about variable expenses and why they matter.

What are variable expenses?

Variable expenses are short-term costs that fluctuate depending on how much a business produces. If output increases, spending goes up. Because variable costs aren’t fixed, companies can adjust them quickly in response to shifts in demand or economic conditions.

Determining total variable costs is easy with this simple formula:

Total variable cost = Quantity of output x Cost per unit

That per-unit cost can vary, depending on the business’s margins and pricing structure.

In manufacturing, companies usually spread variable expenses across entire product lines. For example, if a shoe company purchases 500 pounds of raw materials to make 15,000 pairs of shoes, the entire purchase counts as a variable cost.

Tracking variable expenses helps companies protect their financial health. Here’s how:

Set smart prices: To be profitable, a product's selling price must cover production costs and still be competitive.

Build accurate budgets: Because variable expenses change, companies must closely monitor them to plan production, forecast future demand, and make informed decisions about growth strategies.

Boost profitability: Knowing where money goes helps reduce the break-even point and widen profit margins.

Manage cash flow: Variable expenses affect monthly income. Watching them closely helps companies align goals and resources with real trends, not speculation.

Make faster decisions: Monitoring variable costs in real time better equips companies to pivot, scale, and invest when the moment’s right.

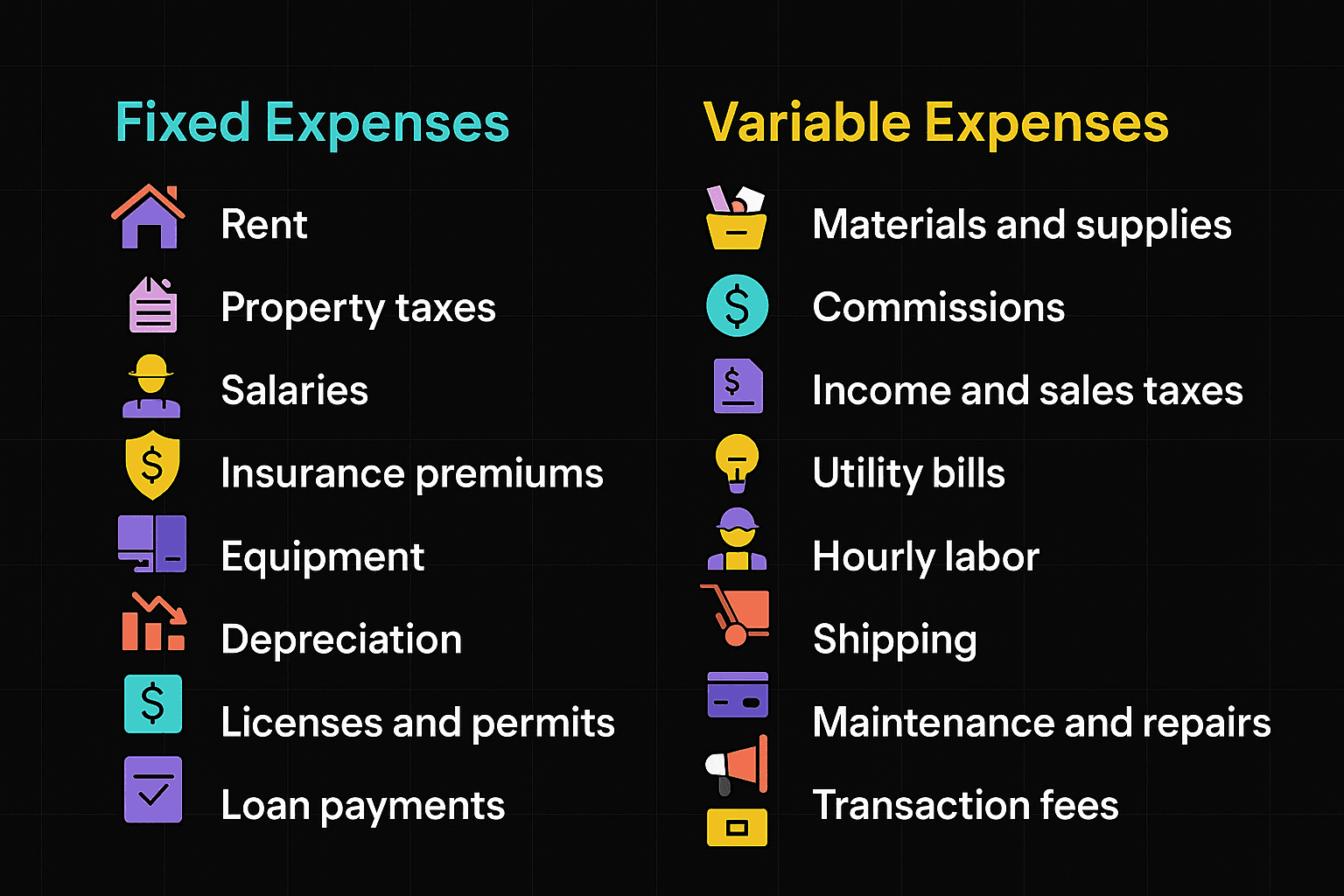

What are fixed expenses?

Fixed expenses are costs that stay the same no matter how much a company produces or sells. These are long-term, recurring expenses are like corporate groceries – things that keep the lights on and the doors open.

Common examples of fixed costs include:

Rent or mortgage: These are regular payments for office or factory space and typically don’t change during the lease or loan term.

Property taxes: Companies typically pay these quarterly or yearly, and the amount stays the same until the next assessment.

Salaries: Salaried employees receive the same compensation each pay period, which makes these costs predictable.

Insurance premiums: Businesses pay regular premiums for insurance policies that cover liability, property, and healthcare.

Equipment: This includes things like office furniture, company vehicles, appliances, and computers, whether purchased outright or through fixed lease payments.

Depreciation: When company equipment loses value over time, that loss counts as a fixed cost.

Licenses and permits: To operate legally, businesses often pay yearly or monthly fees that don’t change unless regulations shift.

Software subscriptions: These are recurring monthly or annual fees for programs or platforms that companies use for things like design, accounting, or project management.

Loan payments: For companies that have loans with a set monthly payment schedule, it’s a fixed expense that covers the loan’s principal and interest.

Because fixed costs don’t fluctuate, they're easy to predict and plan around. There’s no need to monitor them constantly like variable expenses. Periodical reviews are usually enough to make sure they still align with operational needs.

Fixed vs. variable expenses

To understand the difference between fixed versus variable expenses, here are three factors to help you figure it out:

1. Consistency

Variable costs fluctuate depending on how much a company produces. Conversely, fixed expenses stay the same month to month – and sometimes year to year. This makes fixed expenses easier to predict and plan for, while variable expenses need more frequent attention to avoid overspending.

2. Impact on profit margins

Variable expenses affect profits more because they rise as production increases. The more a company makes, the more it spends. Fixed expenses stay the same, however. When output goes up, each unit carries less of the cost. And that helps improve profit margins.

3. Level of control

Companies have more flexibility with variable expenses. They can cut production or negotiate better deals on materials to reduce spending. Fixed expenses are harder to change because things like rent, insurance, and salaries usually stay the same. However, businesses can sometimes lower those costs through loan payment refinancing, switching vendors, or using fewer resources like gas and electricity.

Examples of variable expenses

Variable expenses differ between industries, but you’ll likely find these examples on any expense report.

Materials and supplies: Costs for raw materials go up or down depending on production demands.

Commissions: When sales increase, commission payments to the sales team also rise.

Income and sales taxes: Tax payments often scale with revenue, especially in regions that collect sales tax.

Utility bills: Higher production usually means more electricity and gas use, which drives up utility costs.

Hourly labor: Meeting demand increases may require more seasonal, part-time, or temporary workers.

Shipping: More orders mean higher freight and logistics costs.

Maintenance and repairs: Heavier use of equipment during busy periods can lead to more frequent repairs and servicing.

Transaction fees: As debit and credit card transactions grow, so do payment processing fees.

Marketing: Ad spend often changes from month to month depending on campaign goals, promotions, or spikes in social media traffic.

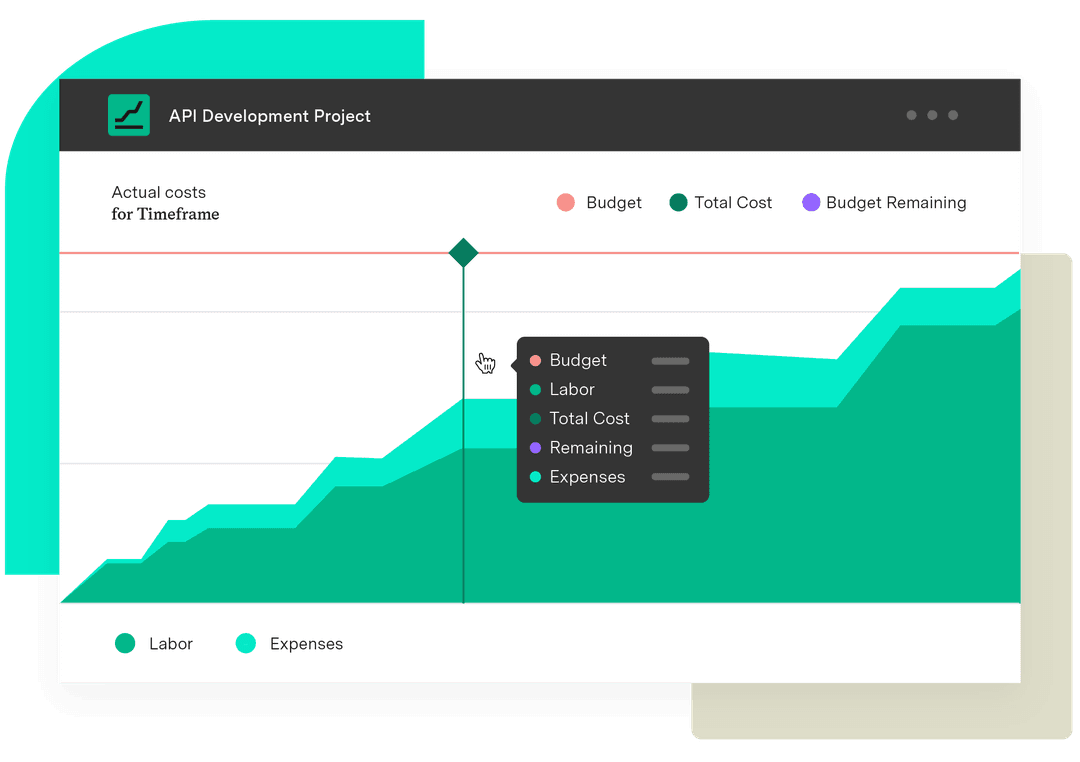

Control costs and forecast budgets better with Tempo

Keeping track of variable costs doesn’t have to drain your time. With Tempo’s Financial Manager, you can monitor and forecast fluctuating costs across your entire project portfolio. It gives you a real-time view of budgets, profit margins, and spending patterns to keep you on top of your spending and protect your bottom line.

Pair it with Tempo’s Capacity Planner to manage staffing more effectively – so you can match the right people to the right work and ensure every project stays on track and within budget.