Impress stakeholders: Navigating how to measure profitability

Tempo Team

There’s more to organizational financial health than the figures on an income statement.

While revenue exceeding expenses indicates profit, discerning its sustainability is key. To do that, business owners must delve deeper into the bottom line to gauge their company’s overall profitability.

Understanding how to measure profitability is essential for pinpointing successful areas and identifying those requiring improvement. It also offers strategic insights into the organization’s long-term goals and objectives, driving informed decision-making.

What’s profitability?

Profit and profitability, often used interchangeably, represent two distinct financial measures that impact a business.

How to calculate profit involves summing up the money an organization earns after they pay all operating expenses. This figure, reported as a specific dollar amount, reflects the business’s absolute earnings.

In contrast, profitability is a percentage. Using a variety of formulas called profitability ratios, accountants analyze and quantify a company’s current, short, and long-term capacity to generate earnings relative to accrued expenses. It’s a crucial assessment for visualizing the overall financial health of the company and its investment potential.

What are profitability ratios?

Profitability ratios are financial metrics that evaluate a company’s ability to generate profit. When combined with efficiency ratios, which evaluate how effectively a business utilizes its resources to generate income, they offer a comprehensive understanding of a company’s financial health.

A profitability analysis, conducted quarterly or yearly, sheds light on an organization’s ability to generate earnings, accounting for aspects such as:

The relationship of earnings to the organization’s revenue

The impact of operating costs

The efficiency in using balance sheet assets

The return provided to shareholder equity

What can you learn from profitability ratios?

Analyzing profitability ratios provides insight into the effectiveness of a company’s management, which influences the organization’s investment opportunities, fundraising capabilities, and credit access. Profitability ratios become even more meaningful when compared with various benchmarks, such as:

The company’s performance in previous years

Competitor performance metrics

Results from similar companies

Industry averages

An upward trend in profitability ratios year over year indicates that a company has a robust growth strategy and is likely to enjoy continued market success. And high profitability ratios often reflect underlying business strengths, such as enhancing market value for its products while simultaneously maintaining or reducing operating costs. These insights prove invaluable for stakeholders, helping them understand the company’s market position and operational efficiency.

11 types of profitability ratios

To understand a business’s operations, there are two main profitability ratio categories: margin and return ratios. The former focuses on a business’s ability to convert sales into profits, while the latter assesses a company’s capacity to generate shareholder returns. Which profitability formula you use hinges on the data available and the specific insights you seek.

1. Gross profit ratio

The gross profit margin is a margin ratio that evaluates the relationship between the cost of doing business and net sales revenue. To determine this percentage, first calculate the gross profit margin by deducting direct expenses and the cost of goods sold (COGS) from the company’s pretax income. Then, divide this number by the net income and multiply by 100 to convert it into a percentage.

Formula: Gross profit ratio = (Gross revenue – direct expenses or COGS / Net revenue) × 100

Variations in the gross profit ratio can signal product or management practices issues.

The net profit ratio follows a similar approach but includes subtracting depreciation, amortization, interest, and income taxes to determine the net profit margin before dividing it by the net revenue.

2. Operating ratio

The operating ratio is a margin ratio that evaluates a business’s operational efficiency. It compares operations costs, including initial inventory investment, purchases, and direct expenses, against the revenue earned.

Formula: Operating ratio = (Operating expenses / Net sales) × 100

A lower operating ratio indicates higher efficiency and profitability, meaning operating expenses consume a smaller revenue portion.

3. Operating profit ratio

Sometimes confused with operating margin, this margin ratio determines the margin between an organization’s revenue and operating expenses, including costs but excluding extraordinary or one-time business activities and income deductions.

Formula: Operating profit ratio = (Net sales – (COGS + Selling, general, and administrative expenses (SG&A) / Net sales) × 100

4. Net profit ratio

The net profit ratio, another margin ratio, evaluates the relationship between net income from sales and the profit after tax deductions.

Formula: Net profit ratio = (Net profit after tax / Net sales) × 100

5. Return on investment (ROI)

Like the return on assets (ROA), return on investment determines the profit derived from an investment, whether purchasing stocks or undertaking a new project. Here are two formulas you can use:

Formula 1: Return on investment = Net return on investment / Cost of investment × 100

Formula 2: Return on investment = (Final value of investment – Initial value of investment) / Cost of investment × 100

6. Return on net worth

Return on net worth (RoNW) or return on equity (ROE) is a return ratio measuring how much profit a company earns using shareholder equity. It allows investors to compare the company’s annual earnings against others from the same industry.

Formula: Return on net worth = (Annual net worth of the company / Shareholders’ equity capital) × 100

7. Earnings per share

The margin ratio earnings per share (EPS) indicates profitability by dividing a company’s profit by the number of outstanding common shares. The higher the EPS, the more profitable the business.

Formula: Earnings per share = (Net income – Preferred dividends) / Weighted average number of shares outstanding

8. Book value per share

Book value per share, another margin ratio, measures a company’s equity on a per-share basis, helping to determine the company’s valuation. An undervalued company typically shows a higher BVPS value than its stock market price.

Formula: Book value per share = (Total equity – Preferred equity) / Total shares outstanding

9. Dividend payout ratio

The dividend payout ratio (DPR) is a return ratio that calculates the proportion of net income a company distributes to its shareholders. A high DPR suggests the company prioritizes paying its investors over reinvesting in its business. Conversely, a low DPR indicates the company’s focus on funding growth and expansion to generate more capital gains for investors.

Here are several ways to calculate DPR:

Formula 1: Total dividends / Net income

Formula 2: 1 – Retention ratio, where the retention ratio is the percentage of net income the company keeps as retained earnings.

Formula 3: Dividends per share / Earnings per share

10. Price earning ratio

The price earning (P/E) ratio is a return ratio determined by dividing the market value per share by the company’s earnings per share. A high P/E ratio indicates that the company’s stock might be overvalued compared to its earnings, while a low P/E ratio suggests the opposite.

Formula: P/E ratio = Current price / Most recent earnings per share

11. Break-even point

Break-even analysis, a margin ratio, calculates the point at which income from units sold equals fixed expenses, indicating when a company will start to turn a profit.

Formula: Break-even point = Break-even point (in units) fixed costs / (Price – Variable Costs)

Profitability isn’t cash flow

Profitability and cash flow are two distinct yet often misunderstood financial concepts. While profitability focuses on a company’s income and expenses, cash flow represents the company’s liquidity or available cash. The difference between profitability and cash flow is critical in financial analysis, as it helps determine how much a company earns and its capability to sustain operations and grow over time.

To calculate net cash flow, compare the business’s revenue inflow with outflows, encompassing fixed and variable expenses.

Using profitability to drive strategic decisions

Profitability ratios aren’t just numbers on a financial statement — they’re tools that organizations can leverage to inform strategic decision-making and shape long-term goals. Use profitability to:

Decide which projects to execute: For example, if increasing operating expenses affects profit margins, avoiding high-cost projects with uncertain ROI might be prudent.

Influence upper management: Presenting profitability analysis as part of a proposal to senior management, along with its projected impact, can make a strong case for the funding and execution of projects or initiatives.

Maintain strategic focus: Keeping profitability in mind, at both the company and project levels, ensures that businesses focus on the broader picture. It’s a constant reminder that their decisions and actions directly affect the organization’s financial health.

Rate realization versus project profitability analysis

Assessing an organization’s financial health can also involve conducting rate realization and project profitability analyses.

Project profitability analysis uses financial and scheduling data to evaluate the profitability of a company’s current operations. It compares the total revenue generated from client work with direct costs like labor and materials, clearly showing how profitable a company’s projects are.

Rate realization analysis compares the potential income a project could’ve generated against the actual revenue earned. If there’s a discrepancy, further examination using accounting software can reveal the factors that hindered the project from achieving its maximum financial potential.

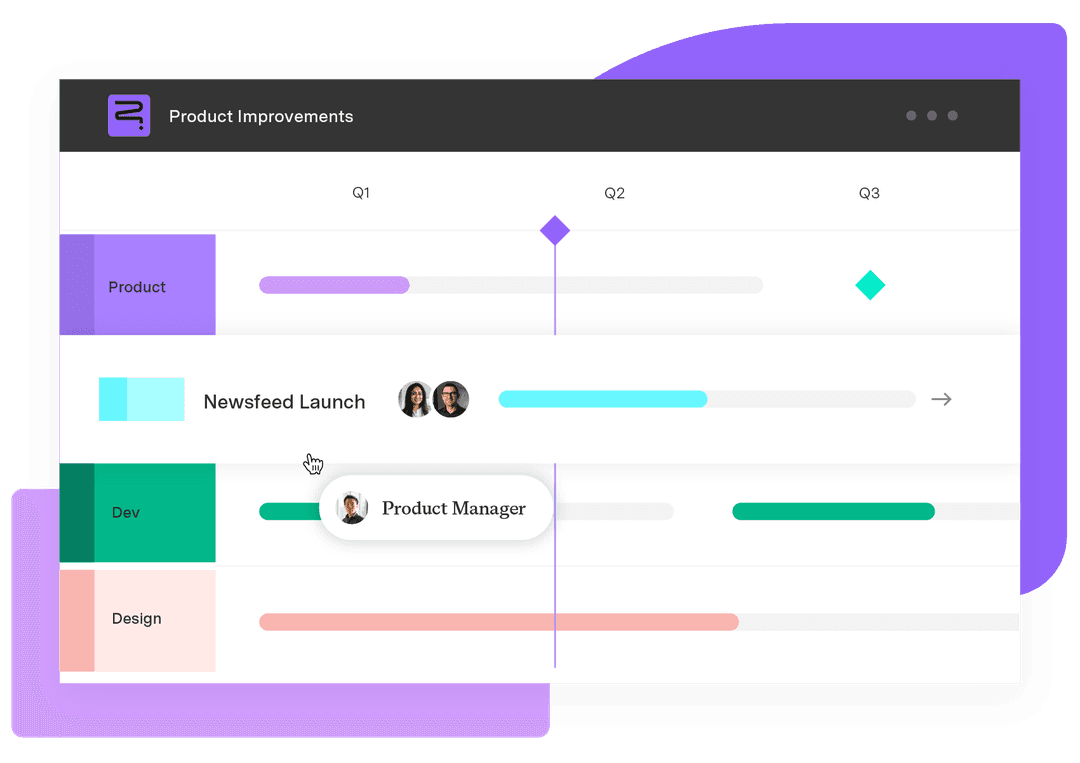

Streamline your profitability analysis with Strategic Roadmaps by Tempo

Use Strategic Roadmaps by Tempo to create audience-friendly roadmaps of your strategic plans to prioritize better projects that will maximize your company’s profitability. Then, pair Tempo Timesheets with Cost Tracker to manage expenses, billable hours, and operating income for a complete overview of project budgets and business finances.