Essential portfolio management metrics, KPIs, and dashboards

Tempo Team

Choosing the right metrics can make or break your portfolio management success. Too few metrics leave you flying blind. Too many create analysis paralysis. The key is selecting metrics that drive decisions and align with how different stakeholders actually work.

Great portfolio metrics guide behavior toward better outcomes. When designed thoughtfully, they create shared understanding across organizational levels and enable faster, more confident decision-making.

This guide breaks down the essential metrics, KPIs, and dashboards for every level of your organization, from executives to operational teams.

Why metric selection matters

Most organizations start with available data and work forward to create measurements, rather than starting with decisions and working backward to required insights.

This approach creates several problems that undermine portfolio effectiveness.

Information overload drowns out critical signals. When everything is measured, nothing stands out as truly important. Stakeholders spend more time interpreting data than acting on insights.

Misaligned metrics drive conflicting behaviors. Teams optimize for what gets measured, even when those metrics don't support broader organizational goals. Local optimization can destroy portfolio-wide performance.

Lagging indicators provide false confidence. Metrics that only reflect past performance give you the illusion of control while problems build in areas we're not watching.

Generic metrics fail audience-specific needs. Executive dashboards cluttered with operational details are as useless as team dashboards that only show high-level strategy metrics.

The solution is building metric frameworks that serve specific decision-making needs at each organizational level.

Ready to turn your portfolio management dashboards into a strategic decision engine?

Download the guideExecutive level dashboards: Strategic oversight and financial performance

Executives need metrics that connect daily operations to strategic outcomes. Their dashboards should answer fundamental questions about portfolio direction, investment effectiveness, and organizational health.

Financial performance metrics

Portfolio ROI and value realization form the foundation of executive financial visibility. Track expected returns versus actual performance across your entire portfolio, not just individual projects. Include both realized benefits and projected future value to maintain a complete investment picture.

Budget variance and burn rate analysis help executives understand spending patterns and make informed allocation decisions. Display planned versus actual spending over time, highlighting areas where costs are trending above or below expectations.

Investment distribution analysis shows how resources align with strategic priorities. Visualize budget allocation across strategic themes, innovation versus operational work, and short-term versus long-term initiatives. This helps leaders identify imbalanced portfolios before they impact performance.

Time to value and payback periods measure how quickly investments generate returns. Track average time from project start to benefit realization, and monitor whether payback periods are improving or extending over time.

Portfolio health overview

Strategic alignment scores quantify how well current work supports business objectives. Measure the percentage of budget and resources dedicated to top strategic priorities. Include coverage metrics that show whether all strategic objectives have supporting initiatives.

Delivery predictability indicators give executives confidence in organizational commitments. Track on-time delivery rates, schedule performance indices, and commitment reliability across the portfolio. These metrics help leaders set realistic expectations with stakeholders.

Risk exposure assessments surface potential threats to portfolio success. Display the number and severity of high-impact risks, along with trend analysis showing whether risk profiles are improving or deteriorating.

Stakeholder confidence metrics capture external perceptions of portfolio performance. Survey key stakeholders regularly to understand their confidence in delivery capabilities and strategic alignment.

PMO level dashboards: Operational excellence and resource optimization

PMOs need metrics that bridge strategy and execution. Their dashboards should support resource allocation decisions, delivery planning, and risk mitigation across multiple projects and teams.

Resource management insights

Capacity versus demand analysis helps PMOs balance workload across the organization. Display available capacity versus requested work across different skill sets and time periods. Include forecasting that shows potential bottlenecks before they impact delivery.

Resource utilization and allocation metrics show how effectively we're using our most valuable assets – our people. Track utilization rates across teams and individuals, but balance efficiency with sustainability. Include skills gap analysis that identifies areas where capability development is needed.

Resource contention indicators highlight competing demands for the same people or skills. These metrics help PMOs identify potential conflicts early and make proactive allocation decisions.

Cross-training and bench strength metrics measure organizational resilience. Track how many people can perform critical functions and whether key person dependencies are decreasing over time.

Delivery performance tracking

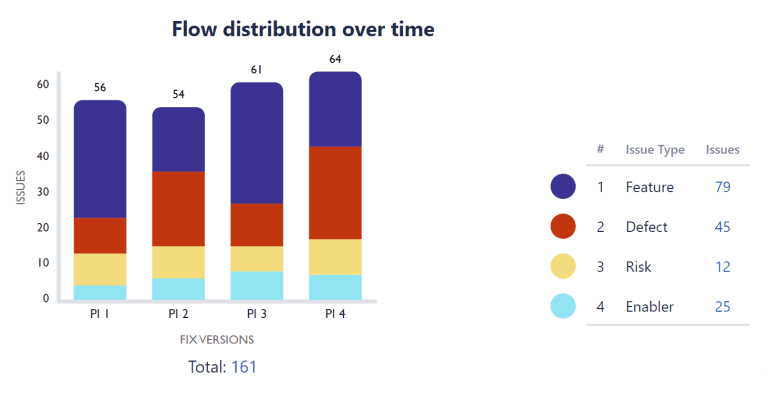

Velocity and productivity trends show whether teams are improving their delivery capabilities. Track story points completed, cycle times, and throughput across different teams and project types. Look for patterns that indicate where support or process improvements are needed.

Milestone and commitment tracking helps PMOs maintain delivery confidence. Monitor critical milestones across the portfolio, highlighting areas where delays might cascade to other initiatives. Include predictability metrics that show how reliably teams meet their commitments.

Quality and rework indicators measure whether speed improvements come at the cost of sustainability. Track defect rates, customer satisfaction scores, and the amount of work that requires rework or revision.

Dependency health monitoring surfaces interconnections that could impact multiple projects. Track cross-project dependencies, their status, and potential impact if delays occur.

Risk and issue management

Risk trend analysis shows whether portfolio risk exposure is improving or worsening over time. Track the number of risks by severity level and monitor how quickly risks are identified and addressed.

Issue resolution performance measures organizational problem-solving effectiveness. Monitor how long issues remain open, escalation rates, and whether teams are becoming better at preventing problems before they occur.

Impact analysis and scenario modeling help PMOs understand potential consequences of delays or problems. Use these insights to develop contingency plans and make informed trade-off decisions.

Operational team dashboards: Execution excellence and continuous improvement

Teams need metrics that support day-to-day work management and continuous improvement. Their dashboards should provide immediate feedback on progress, quality, and team health.

Sprint and iteration management

Sprint goal achievement and velocity form the core of agile team metrics. Track whether teams consistently meet their sprint commitments and how their velocity trends over time. Include predictability indicators that show whether teams are becoming more reliable in their estimates.

Work-in-progress and flow efficiency metrics help teams optimize their workflows. Monitor how much work is active at any time and what percentage of total time is spent actively working versus waiting. These metrics reveal bottlenecks and improvement opportunities.

Lead time and cycle time analysis show how quickly teams can respond to new requests and complete work items. Track these metrics by work type to understand where different kinds of requests typically experience delays.

Burndown and completion trends provide day-to-day progress visibility. These metrics help teams understand whether they're on track to meet sprint goals and identify when course corrections are needed.

Quality and technical health

Code quality and technical debt metrics ensure sustainable development practices. Track test coverage, code review completion rates, and technical debt accumulation. Include trends that show whether quality practices are improving over time.

Defect detection and resolution indicators measure how effectively teams prevent and address quality issues. Monitor defects found by phase, mean time to resolution, and whether teams are catching problems earlier in their development process.

Automation coverage and deployment frequency show how teams are improving their delivery capabilities. Track automated test coverage, deployment success rates, and how frequently teams can release their work.

Performance and reliability metrics ensure that delivery speed doesn't compromise system health. Monitor application performance, uptime, and user satisfaction with delivered features.

Team performance and wellbeing

Team satisfaction and engagement metrics help maintain sustainable performance. Regular team health surveys can identify areas where support is needed before they impact delivery.

Learning and development progress shows whether teams are growing their capabilities. Track training completion, skill development, and knowledge sharing activities.

Collaboration and communication patterns reveal how well teams work together. Monitor cross-functional collaboration, knowledge sharing, and whether teams are becoming more self-sufficient over time.

Innovation and improvement time measures whether teams have space for continuous improvement. Track the percentage of time spent on learning, process improvements, and exploring new approaches.

Cross-cutting dashboard elements: Connecting the complete picture

Some metrics and visualizations serve multiple organizational levels and help connect different perspectives on portfolio performance.

Predictive analytics capabilities

Monte Carlo simulations and forecasting help stakeholders understand likely outcomes and plan accordingly. Use historical performance data to generate delivery date predictions with confidence intervals. This helps set realistic expectations and identify where additional support might be needed.

Trend analysis and early warning systems surface problems before they become crises. Combine leading indicators from different organizational levels to create early warning systems that alert stakeholders when intervention is needed.

Scenario modeling and what-if analysis support strategic planning and risk management. Help stakeholders understand potential impacts of different resource allocation decisions or market changes.

Stakeholder communication tools

Executive summary cards and progress narratives translate complex portfolio data into clear communication tools. Create visual stories that help stakeholders understand not just what's happening, but what it means and why it matters.

Comparison analysis and benchmarking provide context for performance metrics. Show how current performance compares to historical results, industry benchmarks, or organizational targets.

Action item tracking and accountability ensure that insights lead to action. Track follow-up items from portfolio reviews and monitor whether identified improvements are being implemented.

Integration and flow visualization

Value stream mapping and end-to-end flow help stakeholders understand how work moves through the organization. Identify bottlenecks, handoff delays, and opportunities for process improvement.

Cross-portfolio dependencies and ecosystem health surface connections that might not be visible at individual project levels. Track how different portfolios interact and whether external dependencies are performing as expected.

Customer feedback and value realization close the loop between delivery and outcomes. Track whether delivered features are generating expected business value and customer satisfaction.

Metric categories by frequency: When to measure what

Different metrics require different update frequencies to provide value without creating overhead. Matching measurement frequency to decision-making needs optimizes both insight quality and resource efficiency.

Real-time metrics (continuous updates)

System health and performance indicators need continuous monitoring because problems can escalate quickly. Application uptime, performance metrics, and critical error rates should update in real-time to enable immediate response.

Sprint progress and daily standups benefit from real-time visibility. Burndown charts, work-in-progress counts, and blocker status help teams make daily decisions about priorities and resource allocation.

Critical issue resolution requires immediate visibility when problems occur. High-severity bugs, security incidents, and system outages need real-time tracking to coordinate response efforts.

Daily metrics (24-hour updates)

Resource utilization and capacity planning change daily as work progresses and new requests arrive. Daily updates help PMOs make informed allocation decisions without overwhelming stakeholders with constant changes.

Work-in-progress and flow metrics should update daily to help teams optimize their workflows. Queue lengths, cycle times, and bottleneck identification benefit from daily visibility without requiring real-time monitoring.

Quality indicators and defect trends need daily tracking during active development cycles. Daily updates help teams identify quality issues quickly while maintaining focus on delivery goals.

Weekly metrics (weekly updates)

Team velocity and productivity indicators are most meaningful when measured weekly. Weekly updates provide enough data points for trend analysis while smoothing out daily variations that might not be meaningful.

Risk assessment and mitigation progress should be reviewed weekly to ensure that identified risks are being actively managed. Weekly updates provide appropriate urgency without creating administrative burden.

Milestone progress and delivery confidence metrics benefit from weekly review cycles. This frequency aligns with typical sprint cadences and provides regular checkpoints for course correction.

Monthly metrics (monthly updates)

Financial performance and budget analysis align naturally with monthly accounting cycles. Monthly updates provide sufficient frequency for budget management while matching organizational financial reporting rhythms.

Strategic alignment and portfolio health indicators should be reviewed monthly to ensure that operational activities support broader organizational goals. Monthly reviews provide time for meaningful trend analysis while maintaining strategic focus.

Stakeholder satisfaction and communication effectiveness benefit from monthly measurement. This frequency provides enough time between surveys to implement improvements while maintaining regular feedback loops.

Quarterly metrics (quarterly updates)

Portfolio ROI and long-term value realization require quarterly assessment to provide meaningful insights. Quarterly reviews align with business planning cycles and provide sufficient time for benefits to manifest.

Strategic objective progress and organizational capability development should be measured quarterly. These metrics require longer time horizons to show meaningful change and align with typical strategic planning cycles.

Market positioning and competitive analysis benefit from quarterly review. This frequency provides enough time for market changes to become apparent while maintaining strategic awareness.

Choosing the right metrics for your organization

Selecting appropriate portfolio metrics requires understanding your organization's specific context, maturity level, and strategic priorities.

Start with decision-making needs rather than available data. Identify the most critical decisions each stakeholder group makes, then work backward to determine what information supports those choices. This approach ensures that metrics drive action rather than just providing interesting information.

Balance leading and lagging indicators. Lagging indicators tell you what happened, while leading indicators help predict what's coming. Effective metric frameworks include both types to support both accountability and proactive management.

Consider organizational maturity and change capacity. Organizations new to data-driven portfolio management should start with fundamental metrics before adding sophisticated analysis. Build measurement discipline gradually rather than overwhelming stakeholders with complex dashboards.

Align metric frequency with decision-making cycles. Real-time metrics are only valuable if someone can act on them immediately. Match measurement frequency to the speed at which stakeholders can actually respond to changes.

Plan for metric evolution over time. As organizational capabilities mature, metric needs will evolve. Build frameworks that can grow and change rather than static measurement systems that become obsolete.

How Tempo supports comprehensive portfolio metrics

We designed Tempo's Portfolio Collection to support a wide range of portfolio metrics and dashboards.

“Having a consistent view of your entire portfolio is a competitive advantage. With Tempo’s Portfolio Collection, you get tailored insights built on real-time Jira data – with no-code, enterprise dashboards that are effortless for non-technical users to build.” - Nigel Budd, UK Agile Practice Lead at Eficode

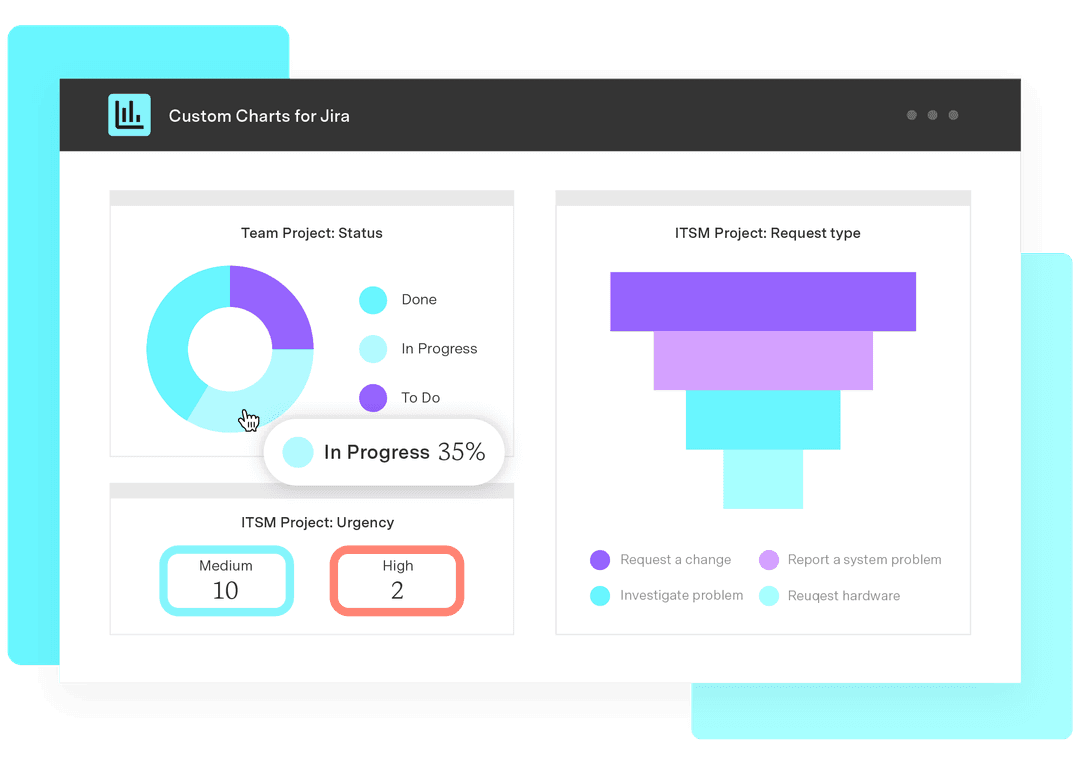

Custom Charts transforms your Jira and data into strategic insights. Instead of exporting data to build charts elsewhere, Custom Charts lets you create executive scorecards, PMO dashboards, and team metrics directly within Jira and Confluence.

Real-time data integration eliminates manual reporting overhead. Our tools automatically pull current information from Jira, creating dashboards that stay current without requiring manual updates or data entry.

Flexible visualization options support different stakeholder needs. Whether you need executive-level strategic alignment charts or operational team sprint burndowns, our platform adapts to your requirements rather than forcing standardized approaches.

Tempo BI Connectors extend insights into enterprise analytics platforms. Connect Jira data to Power BI, Tableau, and other business intelligence tools to create comprehensive portfolio views that combine project information with financial and strategic data.

Automated reporting reduces administrative burden. Generate regular portfolio reports, stakeholder updates, and performance summaries automatically, freeing PMOs and team leads to focus on analysis and action rather than data compilation.

Building your portfolio metrics framework

Implementing effective portfolio metrics doesn't require starting from scratch or replacing existing systems. Focus on building capabilities incrementally while maintaining current operations.

Begin with your highest-impact decisions. Identify the portfolio decisions that most significantly affect organizational success. Build initial metrics and dashboards to support these choices, then expand to other areas.

Involve stakeholders in metric selection and design. The people who will use metrics daily should influence what gets measured and how it's presented. Regular feedback ensures that dashboards serve real needs rather than theoretical requirements.

Start with basic metrics and add sophistication gradually. Establish reliable measurement for fundamental indicators before adding predictive analytics or complex trend analysis. Build measurement discipline first, then enhance capabilities.

Connect metrics across organizational levels. Ensure that team-level metrics roll up into PMO indicators, and that PMO metrics support executive decision-making. This connection helps stakeholders understand how their work contributes to broader success.

Plan for regular review and improvement. Treat your metrics framework as a living system that evolves with organizational needs. Schedule regular reviews to identify what's working, what isn't, and what new metrics might be needed.

The competitive advantage of better metrics

Organizations with sophisticated portfolio metrics consistently outperform those that rely on intuition or basic reporting.

They identify problems earlier and respond faster. Leading indicators and predictive analytics help these organizations address issues while solutions are still available and affordable.

They make more informed resource allocation decisions. Comprehensive visibility into capacity, demand, and performance helps them optimize resource utilization and avoid costly conflicts.

They communicate more effectively with stakeholders. Clear metrics and visual dashboards replace lengthy status meetings with focused discussions about decisions and actions.

They improve continuously rather than reactively. Regular measurement and analysis help them identify improvement opportunities before performance problems force changes.

They build stakeholder confidence through transparency. Consistent, reliable reporting builds trust with executives, customers, and team members who depend on portfolio success.

The organizations that master portfolio metrics don't just manage their work better – they create sustainable competitive advantages that compound over time.

Ready to transform your portfolio visibility with metrics that drive better decisions?

Explore how Tempo's Portfolio Collection can help you build the measurement capabilities your organization needs to thrive.

Get real-time Jira insights for portfolio governance and confident decisions.

Try the Portfolio Collection