Invoice management: A guide to streamlining your process

Tempo Team

Paying bills should be straightforward. A supplier sends an invoice, you approve it, and the money goes through.

If you’ve ever managed invoices, you know it rarely plays out that way. Invoices pile up in boxes, and payments stall when someone holds up approval. What looks simple on the surface often turns into a messy, time-consuming task that frustrates both your team and your vendors.

Strong invoice management changes that. With the right system, you can capture invoices as soon as they arrive, move them through approvals quickly, and process payments on time.

What is invoice management?

Invoice management is the way your business handles bills from suppliers and vendors. It covers every step an invoice takes, from the moment you receive it to when you approve it and make payment. This management process usually includes capturing data, checking for accuracy, routing it through the right approvers, making the payment, and keeping everything on file for future audits or compliance needs.

When you set up a clear invoice management system, you take the guesswork out of accounts payable (AP). Instead of chasing down paper invoices or wasting hours on manual data entry, your team can rely on invoice management software to track transactions and see cash flow real time. This cuts costs and builds stronger vendor relationships.

The 7 key stages of the invoice management process

Every invoice goes through a journey, from the moment you receive it to when it’s archived for audits. Here’s what a healthy invoice management process looks like:

1. Invoice receipt and data capture

Your team receives an invoice, typically by email or as a paper copy. At this point, you capture important data like the vendor name, invoice number, amounts, and purchase order references.

Relying on manual data entry slows you down and increases mistakes. It’s a good idea to use invoice management software that uses AI to automatically capture details and cuts hours off the process.

2. Verification and validation

Once you have the details, you verify that the invoice matches the purchase order or delivery receipt. This protects your business from paying incorrect or fraudulent charges.

3. Approval workflow

Now it’s time to get the green light. You route the invoice through an approval workflow so the different approvers – like department heads or project leads – can sign off.

4. Exception handling

Sometimes quantities don’t align with a purchase order, or prices differ from what you agreed on. That’s when exception handling comes in. A clear exception management process helps your team resolve issues quickly instead of letting payment stall and relationships suffer.

5. Payment processing

After approval, you move to payment processing. Whether you pay by ACH, credit card, or check, this stage makes sure you pay vendors smoothly and accurately. Paying on time builds trust with vendors and may open the door to early-payment discounts that improve cash flow. Many teams now use automated payment workflows to handle this step.

6. Reconciliation

After you pay the bill, reconcile the transactions in your accounting software or ERP with bank statements to make sure you account for every expense. Automated reconciliation reduces human error and gives your finance team clean, accurate data to work with.

7. Archiving and reporting

The final step is storing the invoice in a centralized system. Modern invoice management software keeps a complete audit trail and provides real-time reporting. Instead of digging through file cabinets, you can track invoices instantly and pull detailed reports for audits.

Strong reporting supports smarter decision-making in project management and procurement management. Even product managers can use spending data to inform resource allocation and budgeting, connecting financial processes to broader business strategy.

Challenges of manual invoice management

On the surface, paying an invoice looks simple. But if you’re still relying on manual invoice processing, you probably already know that these outdated methods slow down the process.

Let’s break down the biggest challenges of manual tracking:

1. Time-consuming and inefficient

When you do things manually, every step in the invoice management process takes longer than it should. Someone has to collect the receipt, type details into the accounting system, check it against the purchase order, and send it to an approver. If that person is out of the office, the whole workflow stalls.

Multiply this across dozens of invoices, and your AP team spends hours chasing signatures instead of focusing on higher-value finance tasks that move your business closer to its mission and vision statement.

2. Prone to human error

Manual data entry is one of the biggest risks in invoice management. A single typo can assign the wrong vendor or result in duplicate payment processing.

These mistakes create ripple effects like inaccurate reporting and frustrated suppliers who might lose trust if you don’t pay them on time. Fixing errors after the fact only adds more time-consuming work.

3. Lack of visibility

With paper invoices and email chains, you can’t see the status of an invoice in real time. Is it sitting with an approver? Has the payment gone through? Did procurement verify the purchase order?

This lack of visibility makes it difficult to forecast cash flow or identify bottlenecks before they impact your AP process.

4. Higher processing costs

Manual work is slow and expensive. Printing, filing, and storage all add overhead, while delays in approval can trigger late fees. Over time, these inefficiencies drain both money and resources from your finance team.

5. Compliance and audit risks

Without a digital trail, your records live in inboxes and filing cabinets. Inconsistent management processes and poor data extraction make audits stressful and expose your business to compliance risks. In contrast, an automated invoice management system creates a secure, centralized record of every transaction, making reporting and auditing far less painful.

6 top invoice management software to automate your workflow

Choosing the right invoice management software can make the difference between chasing down late payments and running a smooth, predictable AP process.

Here are some of the top options businesses rely on today:

1. QuickBooks Online

QuickBooks has become almost synonymous with small business finance. Beyond accounting, it doubles as an invoice management system, letting you send invoices and sync with your bank accounts in real time.

Great for: Small to midsize businesses that want everything in one place

2. FreshBooks

If you bill clients for your time, FreshBooks makes life easier. You can track billable hours, turn them into invoices automatically, and even send reminders when payments are overdue. It’s a simple, intuitive option for people who would rather spend less time chasing bills and more time doing the work.

Great for: Freelancers, consultants, and service-based businesses

3. Zoho Invoice

Zoho Invoice offers customizable templates, recurring invoices, and automated reminders – all without a big price tag. It’s one of the most budget-friendly ways to bring automation into your invoice management process.

Great for: Growing businesses that want automation without breaking the bank

4. Bill.com

Bill.com focuses on AP automation. It captures invoice data with AI, routes bills through your approval workflow, and handles payments automatically once approved. Finance teams gain visibility into every step – without juggling emails and spreadsheets.

Great for: Teams dealing with high invoice volumes or complex approval chains

5. Tipalti

If you work with international suppliers or contractors, Tipalti takes the complexity out of global payments. It manages the vendor onboarding and supports payment in over 120 currencies.

Great for: Enterprises or startups scaling across borders

6. Stripe Invoicing

For businesses already using Stripe, adding invoicing is seamless. You can send professional invoices, accept online payments instantly, and even set up recurring billing. It’s straightforward for companies that receive payment online.

Great for: SaaS, e-commerce, and online service providers

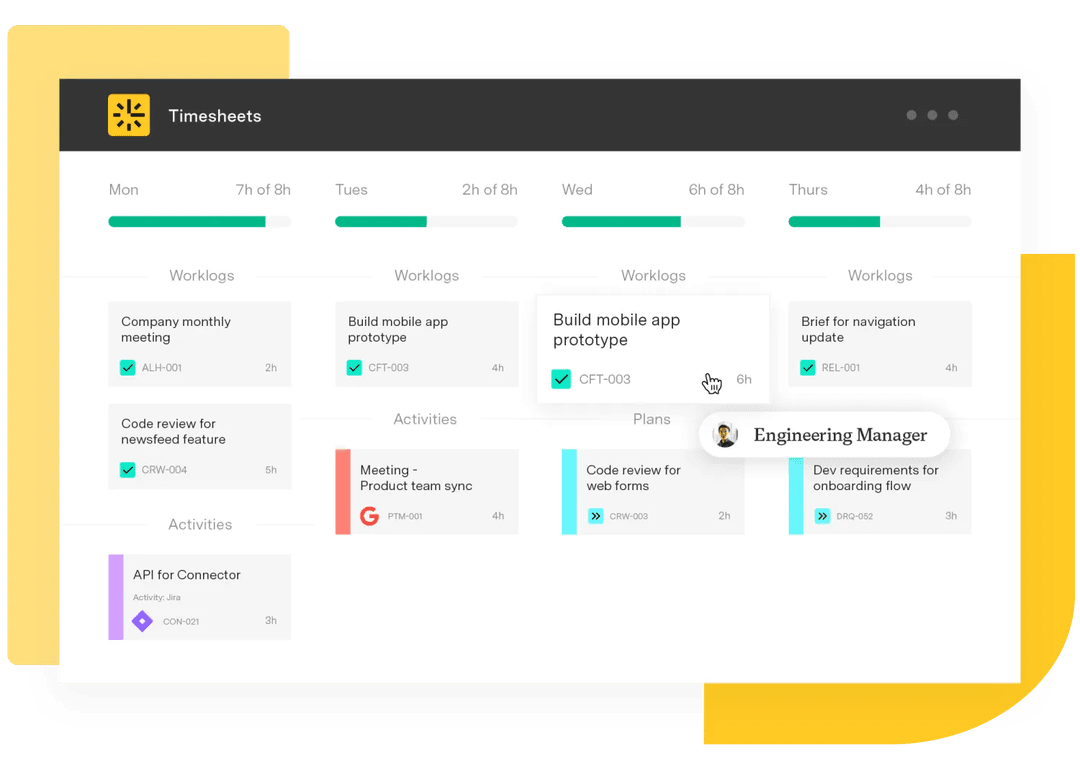

Streamlining billable hours and invoicing with Tempo

The invoice management systems above can help you stay on top of incoming bills. But if you need to track time, you need more tools.

Tempo Timesheets lets your team log time directly in Jira while they work, so every hour connects to the right project and tasks. When it’s time to send an invoice or pay employees, you already have an accurate record. That means fewer delays and invoices that reflect the real work your team delivered.

To take it further, you can pair Timesheets with Custom Charts for Jira to create visual reports that show billable hours and cash flow trends, giving both your team and stakeholders full visibility.

If you want a smoother way to track billable hours and create reliable invoices, try Tempo.