Cost variance formula: How to measure budget performance

Tempo Team

Between shifting priorities, last-minute changes, and unexpected costs, it’s not always easy to tell whether a project is within its budget.

The cost variance formula helps you track this vital metric by comparing your planned budget against actual spending. It reveals whether your budget is on track so you can make informed decisions before minor discrepancies become big problems.

This guide explains how to calculate cost variance, what positive and negative variances mean for your project, and how this metric helps keep your budget in check.

What is cost variance?

Cost variance (CV) in project management is a financial metric that indicates how much a project’s actual costs differ from its budgeted costs. It provides a real-time snapshot of an initiative’s financial health.

Project managers need to understand how to find cost variance to practice effective cost management. It highlights financial issues early, enabling proactive adjustments.

A positive CV means you’re spending less than planned – great news for your budget. A negative CV signals overspending and potential cost overruns. If your CV is zero, you’re right on target.

Cost variance formula

The cost variance formula is a critical tool in project management that helps you track financial performance. Here’s the standard formula to calculate cost variance:

CV = Earned value (EV) – Actual cost (AC)

Let’s explore the other elements of this formula.

Earned value (EV): This is the “earned” portion of your budget – the amount you initially allocated for the work you’ve finished up to this point.

Actual cost (AC): This is the total amount you’ve spent, including fixed overhead costs and variable expenses, like material and labor costs.

The difference between earned value and actual cost is the cost variance (CV). Here’s how to interpret the result:

Positive CV (Favorable variance): A positive cost variance means your project is under budget. You’ve spent less than the earned value of the work completed so far – a sign of efficient cost control.

Negative CV (Unfavourable Variance): A negative cost variance indicates you’ve gone over budget. A cost overrun often stems from unanticipated fluctuations in labor, materials, or overhead costs. It may also indicate scope creep or resource inefficiencies. If left unchecked, it can threaten the project’s success.

Zero CV: If your cost variance is zero, the cost of the work performed aligns with the planned budget. Project stakeholders strive to achieve this equilibrium through cost estimating and cost control.

Cost variance examples

These examples illustrate how the cost variance formula works in real-world scenarios:

1. Software development

A software development team has been working hard on a new application, and it’s time for the project manager to check the budget.

Earned value (EV): $40,000 worth of features completed.

Actual cost (AC): $50,000 spent.

Now, let’s calculate the cost variance:

CV = EV – AC

CV = $40,000 – $50,000 = –$10,000

The project is over budget, with a negative cost variance of $10,000. The cause may be unexpected costs, resource inefficiencies, or delayed timelines. A look at the velocity chart might reveal that development progress has slowed, indicating scope creep or resource limitations. Either way, the project manager should investigate these numbers and course-correct.

2. Marketing campaign

A global marketing campaign is spending its budget on video ads, print materials, and analytics software to track engagement. Halfway through the campaign, the expenses look like this:

Earned value (EV): $25,000 worth of deliverables completed.

Actual cost (AC): $20,000 spent.

Let’s crunch the numbers:

CV = EV – AC

CV = $25,000 – $20,000 = $5,000

In this case, a positive cost variance of $5,000 means the campaign is under budget. Perhaps the team found ways to optimize their efforts, or there were vendor discounts along the way. It’s an advantageous position, but the project manager should continue practicing careful cost management and make sure the team isn’t cutting corners that could result in subpar outcomes.

3. Construction project

Next, let’s examine a construction project. These are often large-scale and complex undertakings, so careful budgeting is crucial.

Earned value (EV): $200,000 worth of work completed

Actual cost (AC): $225,000 spent

So, what’s the cost variance?

CV = EV – AC

CV = $200,000 – $225,000 = –$25,000

The project is over budget, with a negative cost variance of $25,000. This could come from unexpected material costs, delays, or labor inefficiencies. The project manager must act fast to determine the cause and bring the budget under control.

4. Event planning

A corporate event planner is organizing a conference for a large company. They’ve rented a venue, hired caterers, and booked speakers. As with any event, costs can easily spiral without careful cost management, so tracking is vital.

Earned value (EV): $15,000 worth of event planning completed,

Actual cost (AC): $17,000 spent,

Here’s the cost variance calculation:

CV = EV – AC

CV = $15,000 – $17,000 = –$2,000

An unfavorable cost variance of $2,000 means the event is slightly over budget. This might be due to unexpected overhead costs, unusually high attendance, or travel expenses for guest speakers. Although the amount isn’t huge, the planner should dig into the numbers and figure out how to tighten expenses.

Improving cost control with Tempo

Understanding the cost variance formula is just the first step. The real impact comes when you implement it with the right tools.

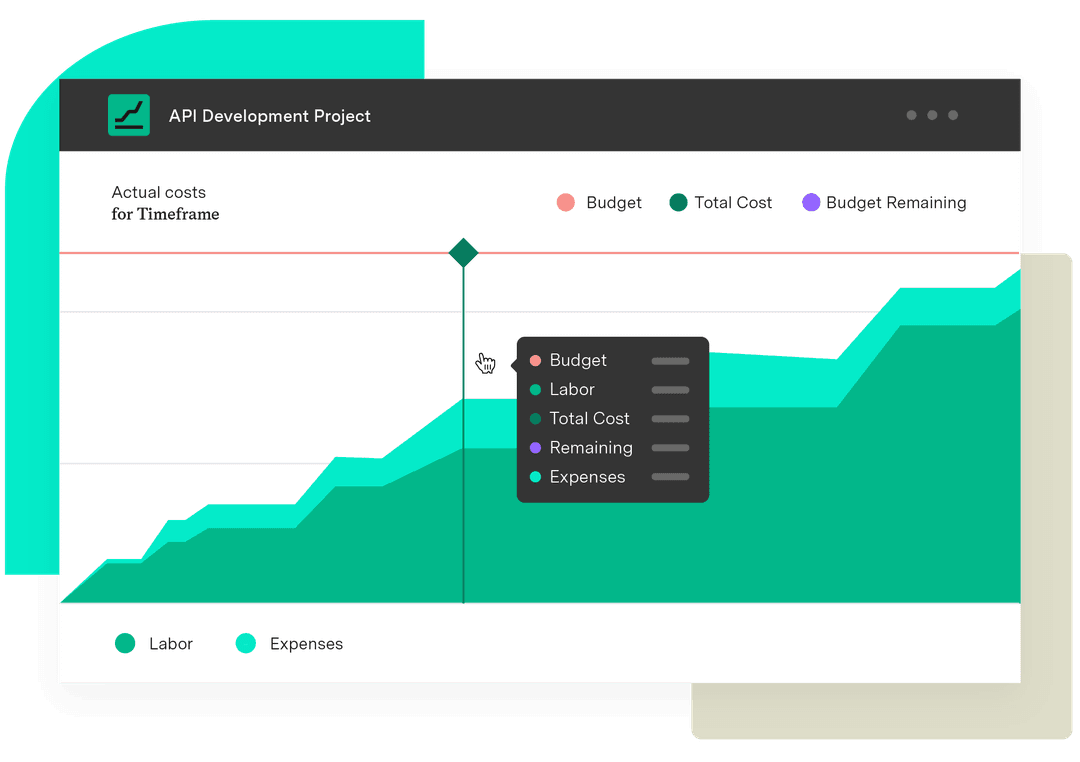

Tempo offers Jira-native financial tracking tools that simplify calculating and monitoring cost variance. Instead of juggling spreadsheets or manually comparing your planned budget with your spending, Tempo centralizes your financial data and project work in one place. It’s ideal for individual project managers and high-level portfolio managers who need visibility across multiple initiatives.

Tempo’s Timesheets application automates calculations to help you track the value of work performed. You can tie time entries directly to costs, enabling accurate earned value calculations and deeper insights into your team’s effort and resource utilization.

By adding on Financial Manager, teams can track labor costs, overhead, and other expenses as they happen, giving project managers and stakeholders complete visibility into budget vs. actuals. You’ll know immediately if you’re at risk of a negative cost variance, so you can prevent overruns.

Try Tempo today and make cost variance calculations easy.