Competitive product analysis: A practical guide for smarter growth

Tempo Team

Brand A and Brand B offer similar products. Brand A is growing fast, but Brand B is floundering. Customer acquisition is time-consuming, and long-time users are switching over to Brand A.

When your company is in this position, it’s very frustrating. You might struggle to determine why you’re losing ground to rivals. Your product is similar, and your messaging hits parallel beats. But your sales are stagnant, while your competitors thrive.

If you don’t know why this is happening, you can’t reverse it. What your company needs is a thorough competitive product analysis. In this guide, you’ll learn how to conduct this type of analysis, and turn your findings into an actionable plan that drives growth.

What’s a competitive product analysis?

A competitive product analysis involves identifying your key competitors and learning everything you can about them. You’ll dig for information about their:

Features

Prices

Target market positioning

User experience

When you do this, you’re not trying to copy these competitors. Instead, you’re looking for insights that can inform your own product development process and messaging.

You may adopt some of the strategies you find, but you’ll adjust them to fit your unique product and goals. Ideally, you’ll also identify what competitors are doing poorly (or not at all), and plan ways to surpass them in those key areas.

What are the benefits and challenges of a competitive product analysis?

In summary, here are the advantages of a competitive product analysis:

Gain better understanding: Learn about your target market and rivals.

Gather insights: Get the data you need to develop and market your product more effectively.

Highlight new growth opportunities: Uncover industry trends and emerging markets.

Identify the latest threats: Discover new competitors' products before they impact your revenue.

This all sounds great, but before you get started, remember that no strategy is perfect. Here some some pitfalls to watch out for, and how to keep them from sabotaging your efforts:

Analysis paralysis: Choosing too many competitors or evaluation criteria can result in overwhelm. It’s best to limit your scope at first, and expand later if you need more information.

Confirmation bias: It’s easy to place too much emphasis on data that supports your existing assumptions about direct competitors' products. To counter this, always ask: “What evidence might prove our assumptions wrong?”

Incomplete or inaccurate data: Pricing pages are often vague, and marketing claims may lean more aspirational than factual. Whenever possible, verify information through third-party sources or direct experience.

Inability to keep up with constant changes: If your competitors are good, they’re likely to evolve often and introduce new products. If you chase after every market shift or release, you’ll never finish the analysis process. It’s best to connect your analysis to a concrete product strategy, and revisit it at regular intervals.

What does a competitive product analysis look like?

Every analysis is unique to a specific company, product strategy, and set of goals. In a moment, we’ll explore the most common stages, but the actions you take should be informed by your existing knowledge of your market and competitors.

That knowledge will also guide you in choosing the right strategic framework to conduct your analysis. There are plenty of options – let’s look at two competitive analysis examples.

SWOT analysis

SWOT stands for strengths, weaknesses, opportunities, and threats. You can conduct a SWOT analysis for each of your direct competitors, then turn your observations into practical strategies.

Let’s say you develop a project management platform, and you’re researching one of your direct rivals (Competitor A). A mini-SWOT analysis might reveal the following:

Strengths: Quick setup and onboarding, strong templates

Weaknesses: Fewer integrations and advanced product features

Opportunities: Mid-market teams abandoning simpler spreadsheet tools

Threats: New features from Competitor B that are attractive to Competitor A’s users

With this information, you can identify ways to compete more effectively with Competitor A.

Positioning maps

A positioning map (or perceptual map) involves plotting your competitors along axes that matter to your buyers. These could be almost anything: time-to-value, enterprise readiness, pricing, ease of use, product reviews, and so on.

Once completed, this competitor analysis framework helps you visualize where the market is crowded and where there may be openings. You can then move into those open spaces with new messaging or additional product features.

How to conduct a competitive product analysis: 4 steps

So how can you get started? Here’s our four-step guide to conducting a successful competitor product analysis. Remember to customize this process to match your unique position and needs, and bring in all relevant team members to gain a broader perspective.

Step 1: Identify your key competitors

First, decide which competitors to focus on. We recommend starting with as complete a list as possible, organized into three segments:

Direct competitors, who are solving the same problems and speaking to the same target audience

Indirect competitors, who provide alternative solutions your target audience is likely to consider

Emerging competitors, who may pose new threats to your business

Then it’s time to select the competitors you’ll include. A small, carefully-curated list is best.

For instance, you might prioritize a few businesses in each category based on popularity, revenue impact, and market positioning. Later, you can expand to include more emerging and indirect competitors or conduct a full market opportunity analysis.

Step 2: Define your analysis criteria

The next step is to decide what you’ll evaluate. Again, focusing on a few key criteria is better than spreading your analysis too thin, as it helps you visualize the data more clearly.

The criteria can be anything, as long as they’re highly relevant to your unique selling proposition. You might gather information about:

Product selling points: Core product features, integrations with other platforms, security, and overall user experience

Commercial aspects: Pricing tiers, ease of implementation, and onboarding/educational options

Marketing strategies: Target audiences, positioning, brand messaging, advertising, and content

Customer feedback: Reviews, overall brand sentiment, case studies, and net promoter scores

If possible, tie each criterion directly to a key decision you need to make, such as adding new product features or repositioning yourself in the target market.

Step 3: Gather competitor data

At last, it’s time to conduct the actual product competitor analysis. How you do this will depend heavily on your chosen evaluation criteria.

So if you’re focused on product analysis, you might explore:

Product pages

Demos/trials

UX breakdowns

If you’re primarily concerned with customer experience, you may gather buyer reviews, testimonials, and community threads. And if you want to improve marketing strategies, you’ll need to explore key SEO metrics and messaging choices.

No matter where you choose to invest these efforts, don’t rush the process, and lean on a wide variety of sources and tools. You’ve narrowed your focus to a few competitors and criteria. As a result, you can afford to dig deep into each one, and amass enough information to draw clear conclusions.

Step 4: Analyze your findings and create a plan of action

Once you’ve completed the research phase, you’ll need to analyze the data. This is much easier if you take the time to organize it first, using one of the methods we described above or a competitive analysis template.

Then look for any patterns or gaps. This is the time to ask questions like:

What common usability features does your product lack?

What features do customers love or hate in competitors' products?

What messaging seems to resonate most with target audiences?

Your goal is to find data-driven insights you can translate into specific actions. If you own an email marketing platform, for instance, your analysis might reveal that your tool lacks advanced automations some rivals offer. This suggests a clear solution – investing in similar (or better) automation tools.

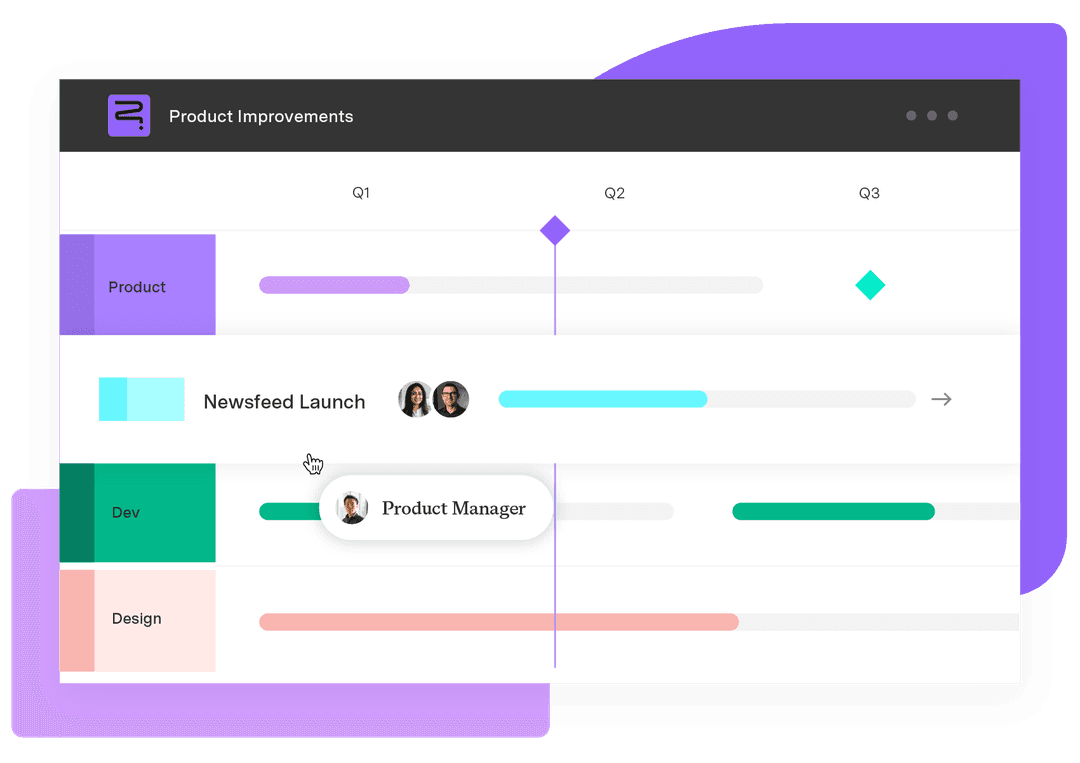

Take your product strategy to the next level with Tempo

Competitive product analysis helps you identify differentiators, focus your resources, and create a clear, actionable plan of attack. However, the insights you gather are only valuable if they lead to meaningful change.

Implementing what you learn is by far the most challenging step. Fortunately, Tempo’s extensive product management suite is here to help.

With Idea Manager for Strategic Roadmaps, you can:

Centralize ideas from your analysis: Capture your hypotheses as Ideas, and add context to each one (such as audience segments or evidence).

Link real feedback to each Idea: Using the feedback portal, you can collect comments, win/loss notes, and support signals, then connect them directly to Ideas.

Prioritize with built-in competitor analysis frameworks: Score your ideas according to your chosen framework and criteria, and even create custom weighted models.

Convert winners into actionable steps: When an Idea is a clear winner, you can move it to a timeline and align it with your goals.

Our platform helps you translate research into a powerful plan. Transform ideas into insights, and then into concrete, achievable projects.

Don’t just keep pace with the competition. Become a leader in your space with Tempo’s Idea Manager for Strategic Roadmaps.