Competitive analysis template for strategic insights

Tempo Team

No matter your industry, understanding your competitors is essential to making smart business decisions. A competitive analysis template helps to not only track your competitors, but also to identify your own strengths and weaknesses. It’s a structured framework that guides teams in uncovering opportunities to stand out.

This guide explains what a competitive analysis template is, explores different types of analysis, and offers a repeatable process for evaluating your competitive landscape. You’ll also find common templates used by marketers, strategists, and product teams, plus a look at how Tempo tools like Strategic Roadmaps and Timesheets for Jira help teams outmaneuver their competition.

What’s a competitive analysis template?

A competitive analysis template is a structured tool that helps teams collect and organize data about other businesses operating in the same space. It breaks down relevant details like product features, pricing models, messaging, customer sentiment, and market share into a format that supports better decision-making.

Templates vary in complexity, but the goal stays the same: to compare competitors side by side, find gaps in the market, and align your product or service with real opportunities.

Whether you’re planning a new launch or refining your positioning, a competitive analysis template gives you a clear snapshot of where you stand and where you could go next. This template also allows you to work within broader strategy frameworks, like SWOT analyses, to guide long-term success.

Types of competitive analysis

Different types of analysis answer different strategic questions. Below are several useful methods, each suited to unique situations:

Competitive landscape

A competitive landscape analysis identifies the major players in your product or service category and maps how they compare on key factors like market share, product range, pricing, and geographic reach.

Use this approach when:

Entering a new market

Evaluating saturation or fragmentation

Scoping out industry trends

Competitor overview

A competitor overview is a quick summary of a specific rival. It typically includes facts about their product line, pricing model, target audience, recent funding, and notable partnerships or announcements. This is ideal for sales teams, executive updates, and tactical planning.

Market positioning analysis

This type of analysis focuses on how brands are perceived by customers. You might use perceptual maps or feature comparisons to see how your offering compares across attributes like value, speed, usability, and innovation. Market positioning analysis is essential for refining your go-to-market strategy or preparing for a rebrand.

Customer sentiment analysis

Customer sentiment analysis looks at what people are saying about your competitors. This might include analyzing:

Product reviews

Support tickets

Social media comments

Third-party ratings

Tracking customer feedback can reveal gaps in support or service that impact brand loyalty. Sentiment analysis insights often inform better client relationship management strategies.

Competitive differentiation analysis

This analysis highlights how your product or service genuinely differs from others in the market. It compares features, messaging, customer experience, and brand promise to identify unique value propositions.

Use it to:

Pinpoint areas of competitive advantage

Improve differentiation in sales conversations

Guide messaging and product development efforts

How to conduct a competitive analysis effectively: 6 steps

A strong competitive analysis is structured, focused, and repeatable. Follow these six steps for doing a competitive analysis that uncovers meaningful insights:

1. Identify your top competitors

Start by identifying the companies that directly or indirectly compete with your offering. These can include:

Direct competitors selling similar products to the same audience

Indirect competitors solving the same problem in a different way

New market entrants that could become threats

Prioritize your list based on relevance, market activity, and how frequently they come up in customer conversations. Keep the list focused so your analysis remains manageable and actionable.

2. Select evaluation criteria

Are you trying to refine positioning, improve features, or adjust pricing? Choose the specific attributes you’ll use to compare competitors.

Standard evaluation criteria include:

Product capabilities and feature depth

Pricing tiers and contract terms

Customer satisfaction or NPS scores

Time to value or onboarding process

Sales messaging and brand tone

Tailor your criteria to your stakeholders. What matters to marketing may differ from what your product department or leadership suite needs.

3. Gather data

Collect data from both internal and external sources. Some datasets you might be interested in are:

Website audits

Product demos

Customer reviews

Analyst reports

Sales team feedback

Use consistent sources across competitors to avoid skewed results.

4. Analyze insights

Look for trends and gaps in the data. Ask yourself:

What are our competitors doing well that we aren’t?

Where do customers express dissatisfaction with other tools?

Which messages resonate most in the market?

Are there feature gaps we can fill quickly?

Once you have answers to these questions, you’ll be ready to make strategic decisions that support better product velocity and cross-team alignment.

5. Share findings with stakeholders

Make your analysis accessible and digestible. Create a summary that highlights key takeaways and implications for each department. Then, tailor the format for different stakeholders. For example:

Product teams may need a feature comparison

Sales may want battle cards or talking points

Executives may prefer a high-level snapshot or dashboard

Encourage feedback from various teams – the more collaborative the process, the more useful your analysis becomes.

6. Revisit and update regularly

Competitive landscapes shift quickly. As markets evolve and new trends emerge, revisiting your competitive analysis regularly ensures you remain relevant and agile. Build a rhythm for updating your analysis:

Set a cadence (e.g., quarterly or biannually)

Assign ownership to a specific team or person

Reassess your evaluation criteria and competitor list as needed

Treat your competitive analysis as a living document that grows with your business. Consistent updates will keep your strategy sharp and your messaging relevant.

Types of competitive analysis templates

There are many ways to format and visualize competitive data. Here are a few commonly used competitive analysis templates that work across industries:

Basic comparison matrix

A basic comparison matrix is a simple side-by-side table that lists competitors along the top and evaluation criteria along the side. This format works well for quick internal reviews and helps teams easily spot differences.

SWOT analysis

SWOT stands for strengths, weaknesses, opportunities, and threats. The SWOT analysis helps teams think holistically about how each competitor operates and where the risks or opportunities lie. You can run a SWOT for one competitor or compare multiple brands side by side.

Marketing analysis

A marketing competitive analysis focuses on how competitors are positioning themselves to buyers. It covers messaging, content, campaigns, channel strategy, and advertising tone.

Use this format to:

Refine your own marketing strategy

Spot overused or underused channels

Differentiate your messaging

Templates can be adapted to different audiences. A product team may need a feature-focused view, while a CMO may prefer a snapshot of brand sentiment and campaign activity. If you're just getting started, a competitor research template can provide a repeatable starting point for your team.

Feature-benefit analysis

This template compares specific product features across competitors but goes one step further by tying each feature to a customer benefit. It helps teams focus on value, not just functionality. This approach is especially helpful for product marketing and sales enablement.

Enhance strategic alignment and decision making with Tempo

A competitive analysis reveals where your business stands in the market, but knowing where you are is only the beginning.

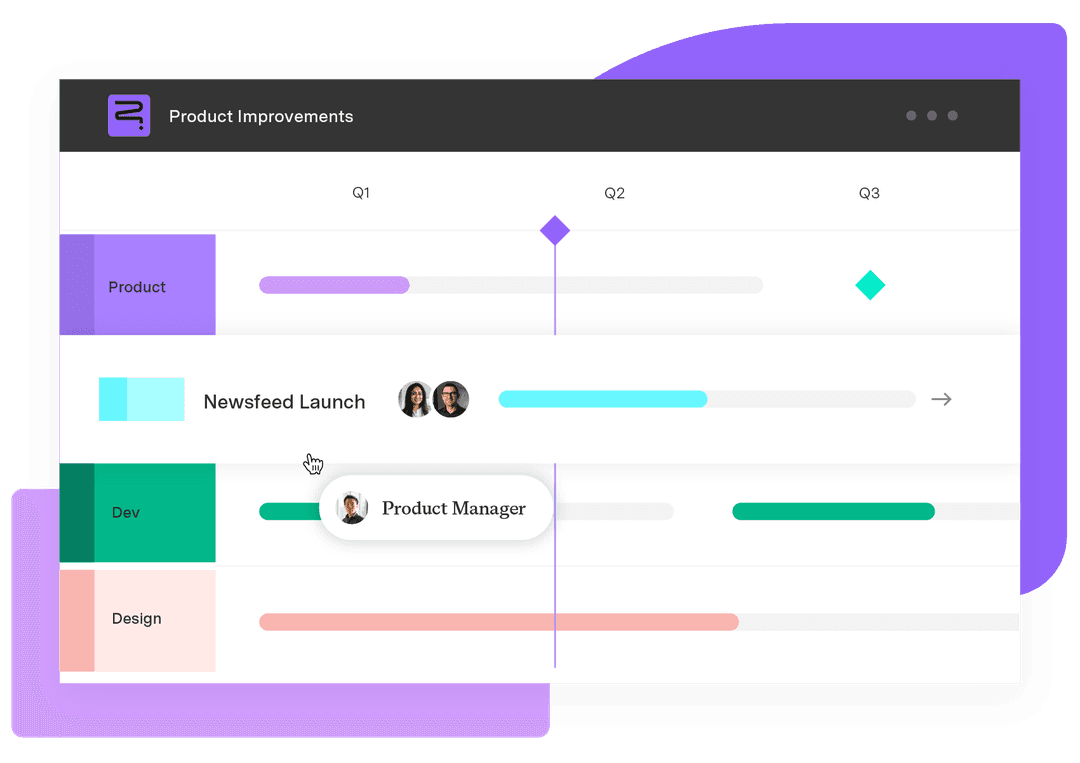

With Strategic Roadmaps, teams can map long-term initiatives across departments, align those efforts with high-level business goals, and clearly communicate progress to stakeholders. This ensures everyone moves in the same direction, guided by the same strategic priorities.

Timesheets for Jira adds another layer of visibility by showing how time is actually being spent on those initiatives. This allows teams to evaluate whether their execution aligns with what the competitive landscape demands and supports a more responsive operations strategy.