Stakeholders vs. shareholders: 6 key differences

Tempo Team

Whether you’re managing a small proposal or leading a large-scale initiative, the needs of different groups across your company will influence your decisions. Two of the most important are stakeholders and shareholders, but their roles, priorities, and influence on project outcomes differ in major ways.

Understanding these differences is essential for driving long-term project success. In this guide, we’ll distinguish stakeholders versus shareholders, explore stakeholder and shareholder theory, and show how Tempo’s Jira-native tools help teams meet the needs of both parties.

What’s a stakeholder?

A stakeholder is any individual, group, or organization that can affect or is affected by the outcomes of a business or project. This includes anyone with a vested interest in how the organization performs or operates.

Organizational stakeholders often influence strategic decisions and day-to-day operations even if they don’t have a financial stake. Conducting a stakeholder analysis early in a project can help teams prioritize competing needs and identify high-impact groups.

Stakeholders fit into two broad categories: internal versus external. Here’s a quick overview:

Internal stakeholders are people within the organization, such as employees, managers, and executives. They contribute directly to the business and are impacted by decisions around workflow and company culture.

External stakeholders include customers, suppliers, regulators, community members, and advocacy groups. These groups are affected by a company’s products and services, even if they aren’t directly involved in operations.

To further improve collaboration and engagement, it’s worth building strong relationships with project stakeholders. Understanding who stakeholders are in a company helps project managers, executives, and team leads design initiatives that meet both internal needs and external expectations.

What’s a shareholder?

A shareholder is an individual or entity that owns at least one share of a company’s stock. Shareholders have a financial interest in the company’s performance and may receive returns in the form of dividends or capital gains. Public shareholders buy stock through exchanges, while private shareholders often include founders, investors, or institutional partners.

While stakeholders may care about a wide range of outcomes, shareholders primarily focus on financial return. Their influence often depends on their investment size and voting rights within the company. Larger shareholders, especially institutional investors, can sway decisions at the board of directors level or influence executive compensation structures.

All shareholders are stakeholders, but not all stakeholders are shareholders. This distinction is central to understanding how businesses prioritize decision-making.

6 differences between a shareholder and a stakeholder

The terms shareholder and stakeholder are sometimes used interchangeably, but they reflect different relationships to the organization. Below are six key differences between shareholders and stakeholders.

1. Scope of interest

Stakeholders may be concerned with ethics, working conditions, community impact, customer satisfaction, and social responsibility.

Shareholders, especially major ones, typically focus on profitability, earnings per share, and the market value of their investment – macro over micro.

2. Relationship to the organization

Stakeholders may interact with the organization through employment, regulation, or supply chains.

Shareholders engage primarily through ownership. Their influence is often exercised via votes or stock movements.

3. Goals and time horizon

Stakeholders tend to prioritize long-term health, including organizational stability and corporate social responsibility.

Shareholders may be more focused on short-term returns, especially if they plan to divest in the near future.

4. Level of control

Stakeholders like employees or customers may influence decisions through feedback or pressure campaigns, but don’t usually have direct voting rights within the company.

Shareholders may hold voting power that allows them to approve or reject decisions made by the board of directors.

5. Legal standing

Stakeholders may lack formal legal protections depending on their relationship to the company, however most non-contract employees will usually have some form of legal protection.

Shareholders often have clearly defined legal stockholder rights, such as access to financial reports or the ability to sue for mismanagement.

6. Examples in practice

In a software rollout, stakeholders might include developers, clients, IT support, end users, and anyone affected by the change.

Shareholders, in contrast, are primarily interested in whether the project improves revenue or valuation.

Shareholder theory vs. stakeholder theory

Two major frameworks help explain how companies make decisions about which group to prioritize: shareholder theory and stakeholder theory.

Shareholder theory

This view, often associated with economist Milton Friedman, argues that a company’s primary responsibility is to maximize value for its shareholders. According to this theory, businesses best serve society by generating profit, paying taxes, and distributing returns to investors.

Under this model, ethical or social considerations are secondary to financial performance unless they directly affect the bottom line.

Stakeholder theory

Stakeholder theory takes a broader view. It suggests that companies should consider the interests of all stakeholders when making decisions. This includes employees, customers, suppliers, communities, and regulators. Corporate social responsibility initiatives are one way organizations embody stakeholder theory.

The theory argues that by supporting these groups, companies build long-term resilience, reduce risk, and earn public trust. A stakeholder approach often leads to better brand reputation and more sustainable growth.

Understanding the role of stakeholders is especially important in an agile environment, where frequent iteration and continuous feedback are core to success. Agile teams risk misalignment, missed expectations, and reduced value delivery without strong stakeholder involvement.

The debate between stakeholder theory versus shareholder theory continues to shape business ethics and corporate governance structures. In practice, most modern organizations take a hybrid approach that balances shareholder interests with broader stakeholder obligations.

Support stakeholder alignment with Tempo tools

Effective project delivery depends on managing the project expectations of stakeholders and shareholders. Tempo’s tools support strong project governance by connecting stakeholder-level execution with shareholder-level strategic oversight.

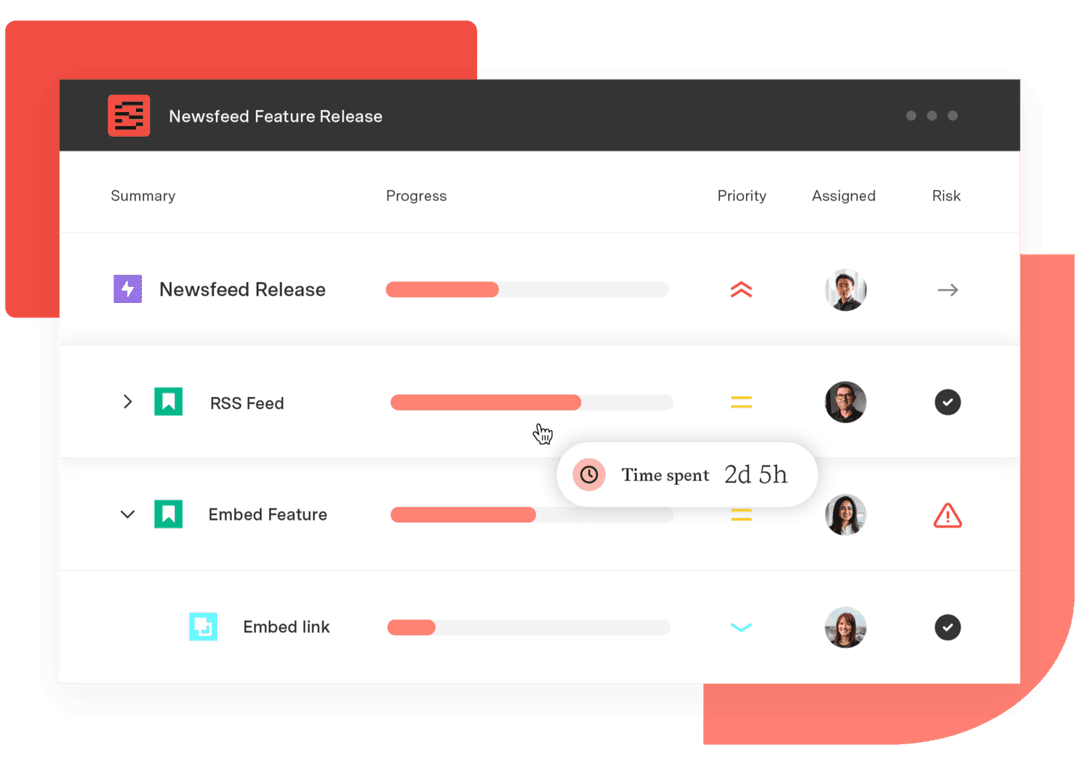

With Structure PPM, teams can organize projects into clear, hierarchical views that reflect stakeholder requirements and shareholder goals. The tool supports flexible project planning, making it easier to see how tasks connect to business outcomes. Managers can model dependencies, allocate resources, and update timelines directly in Jira.

Timesheets enables teams to track effort accurately and compare it to budgeted hours. This improves alignment across departments and enhances accountability when reporting to leadership. With detailed logging and category tagging, stakeholders can see how time is being spent and whether that effort follows the original plan. Automated scheduling enhances this visibility and reduces the risk of delays.

Lastly, Strategic Roadmaps offers visual timelines that help teams communicate progress clearly and show how initiatives support broader business goals. This tool is especially useful for sharing boardroom-ready updates with leadership and keeping departments aligned on future priorities.

Whether you’re analyzing community impact or delivering a quarterly revenue report, Tempo’s Jira-native tools help organizations align stakeholder and shareholder needs with the broader strategic priorities of both parties.