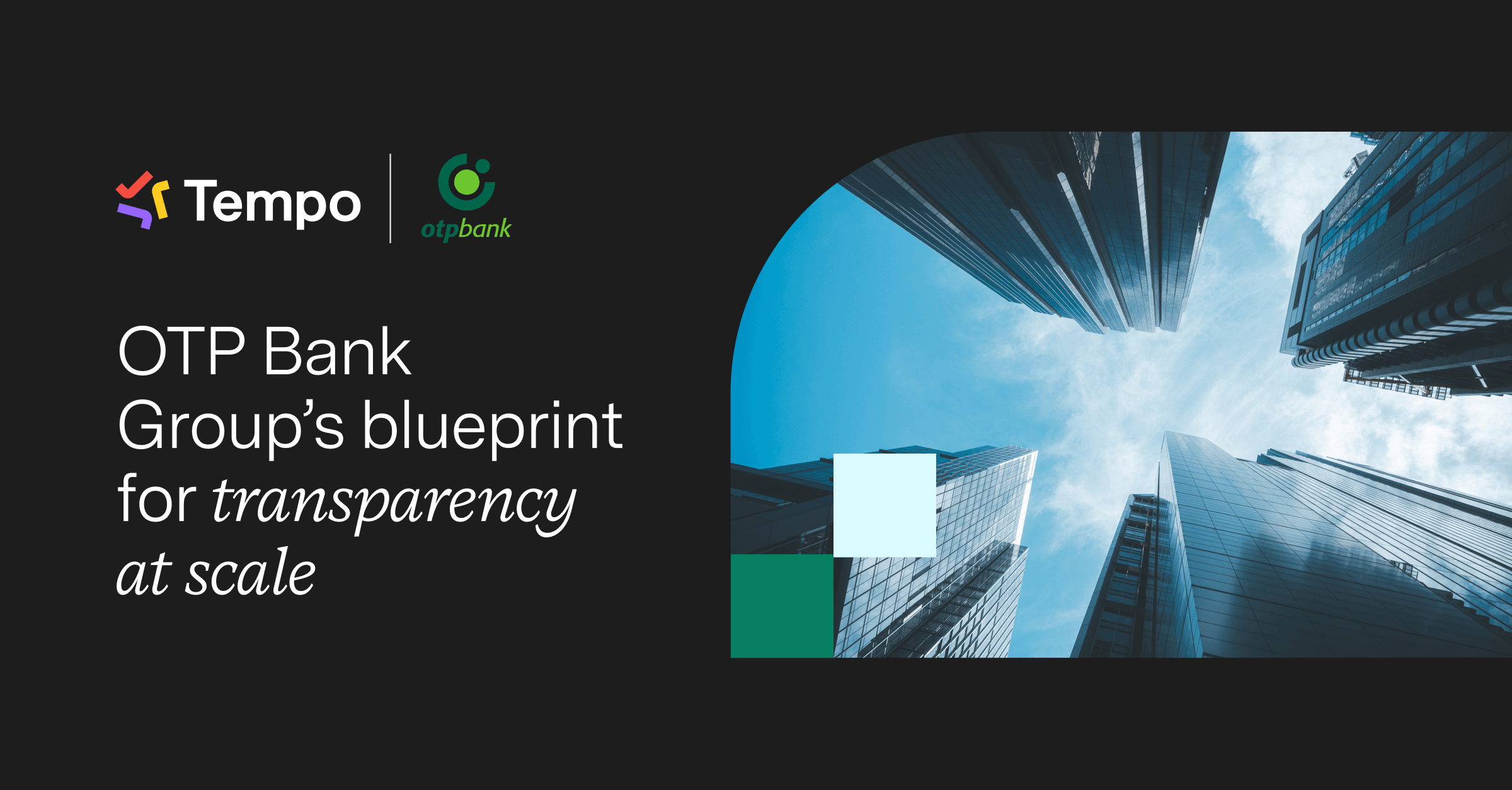

OTP Bank Group’s blueprint for transparency at scale

Tempo Team

Overview

As one of Central and Eastern Europe’s leading financial groups with over 40,000 employees, OTP Bank Group is growing fast – expanding into new territories and adding complexity across its network of subsidiaries.

Growth of that scale comes with the need for greater control. To scale effectively, OTP had to overhaul how work was planned, tracked, and governed across the enterprise.

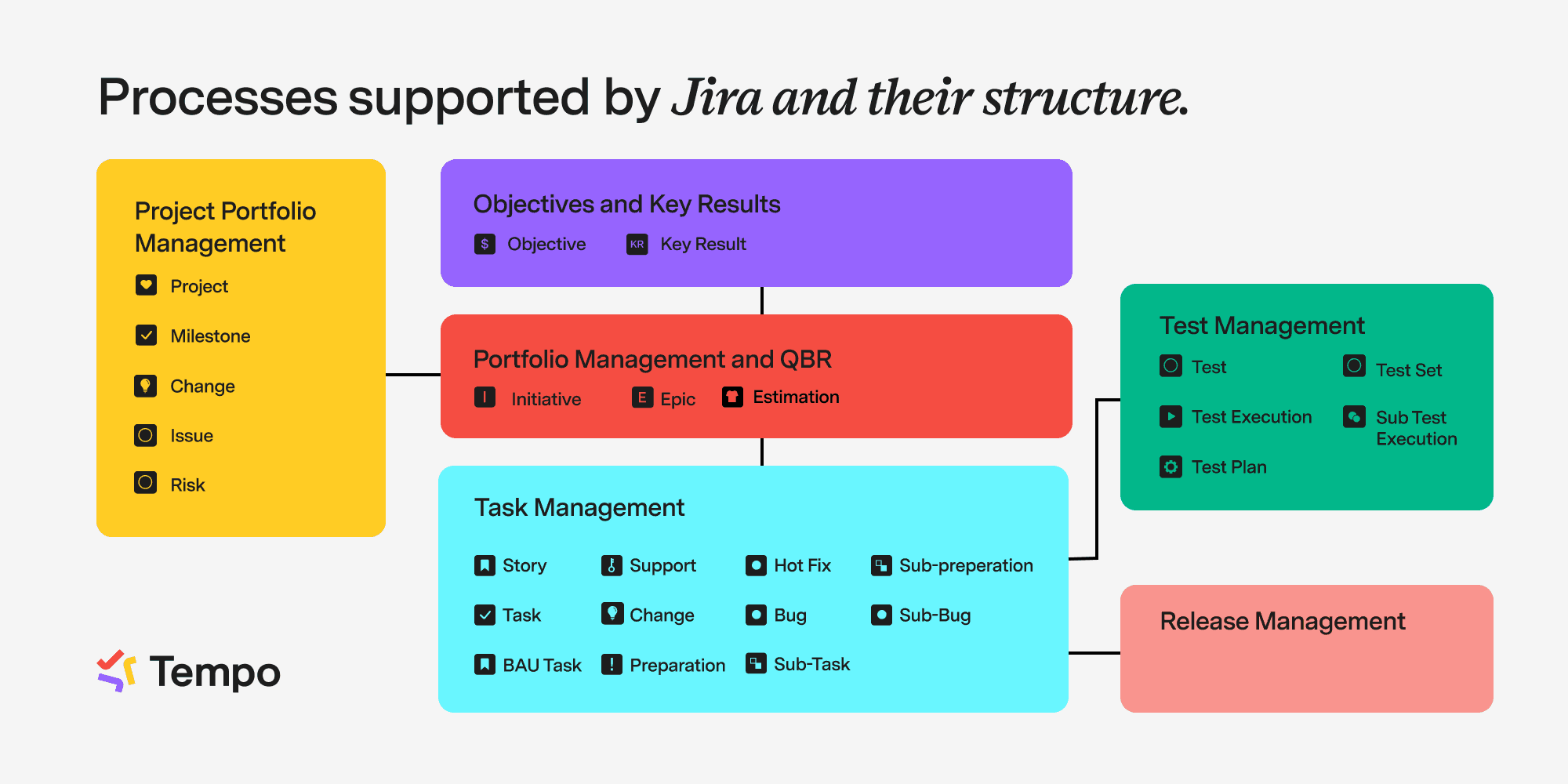

After migrating to Jira Cloud and rationalizing over 60 plugins, OTP chose Tempo’s integrated solution set to standardize key workflows – from leadership-level OKRs to team-level execution.

To meet the workflow issues they had, OTP adopted Timesheets, Structure PPM, and Capacity Planner. The result: Increased transparency, better planning, and tighter compliance across every layer of the organization.

The challenge: Too many tools, not enough transparency

OTP Bank Group’s transformation was driven by multiple intersecting challenges:

Fragmentation and risk: With dozens of Jira plugins in use across the group, managing cost, security, and compliance became a major burden. Each plugin required separate contracts and scrutiny – untenable under EU banking regulations and internal audit standards.

Cloud migration complexity: Migrating to Cloud meant every plugin became a distinct vendor. OTP’s IT security team required strict compliance, such as DORA (Digital Operational Resilience Act) – creating enormous friction for multi-vendor environments.

Scattered processes: Agile was well established, but used inconsistently across hundreds of teams. OTP had accumulated dozens of different tools for planning, reporting, and delivery – undermining standardization and visibility.

Strategic visibility gaps: Leadership needed transparency from strategic objectives (OKRs), through quarterly business reviews (QBRs), down to execution. But Jira’s native capabilities couldn’t offer the layered alignment required across subsidiaries, departments, and delivery squads.

Clarity at every level thanks to the Tempo platform

OTP Bank Group chose to consolidate around a group-wide solution built on Tempo’s integrated platform – Structure, Gantt Charts for Structure, Capacity Planner, and Timesheets – enabling consistent planning, execution, and governance across thousands of users.

Structure and Gantt Charts – Transparently connecting strategy to execution

From executive OKRs to team backlogs, Structure provides a flexible, hierarchical view of work across all levels of the bank.

Leadership alignment: Top-level OKRs are tracked and reviewed in Structure, enabling clear oversight into ongoing initiatives.

QBR planning: Tribe and squad leads use custom views for quarterly planning, delivery reporting, and resource estimation. Additionally, the QBR department uses Structure to manage its quarterly planning.

Agile at scale: Hundreds of squads and chapters use tailored structures to manage backlogs, track epics, and visualize progress with Gantt Charts for Structure.

“The best feature is the flexibility – Structure lets us build the view we need. It’s not one-size-fits-all. That’s critical across our subsidiaries and squads.” Dávid Törő, Head of PMO, OTP Bank Group

Capacity Planner – Planning resources with growing precision

As OTP scales agile delivery and cross-subsidiary collaboration, Tempo’s Capacity Planner is becoming an increasingly valuable tool in the bank’s planning toolkit.

Their agile teams and product owners have used the tool to allocate and forecast resources at the beginning of each quarter, and several business units (including the Serbian subsidiary) have adopted Capacity Planner to map IT capacity and project requirements.

While the Bank plans at team/IT system level, Capacity Planner also has the option for teams to plan and manage capacity at a more detailed (individual) level as well – providing flexibility in their approach.

“Teams are seeing the value. It’s not yet mandatory across the group, but adoption is growing. It helps us plan smarter, especially when tied to Structure views.” Gergo Papp, CoE Lead, OTP Bank Group

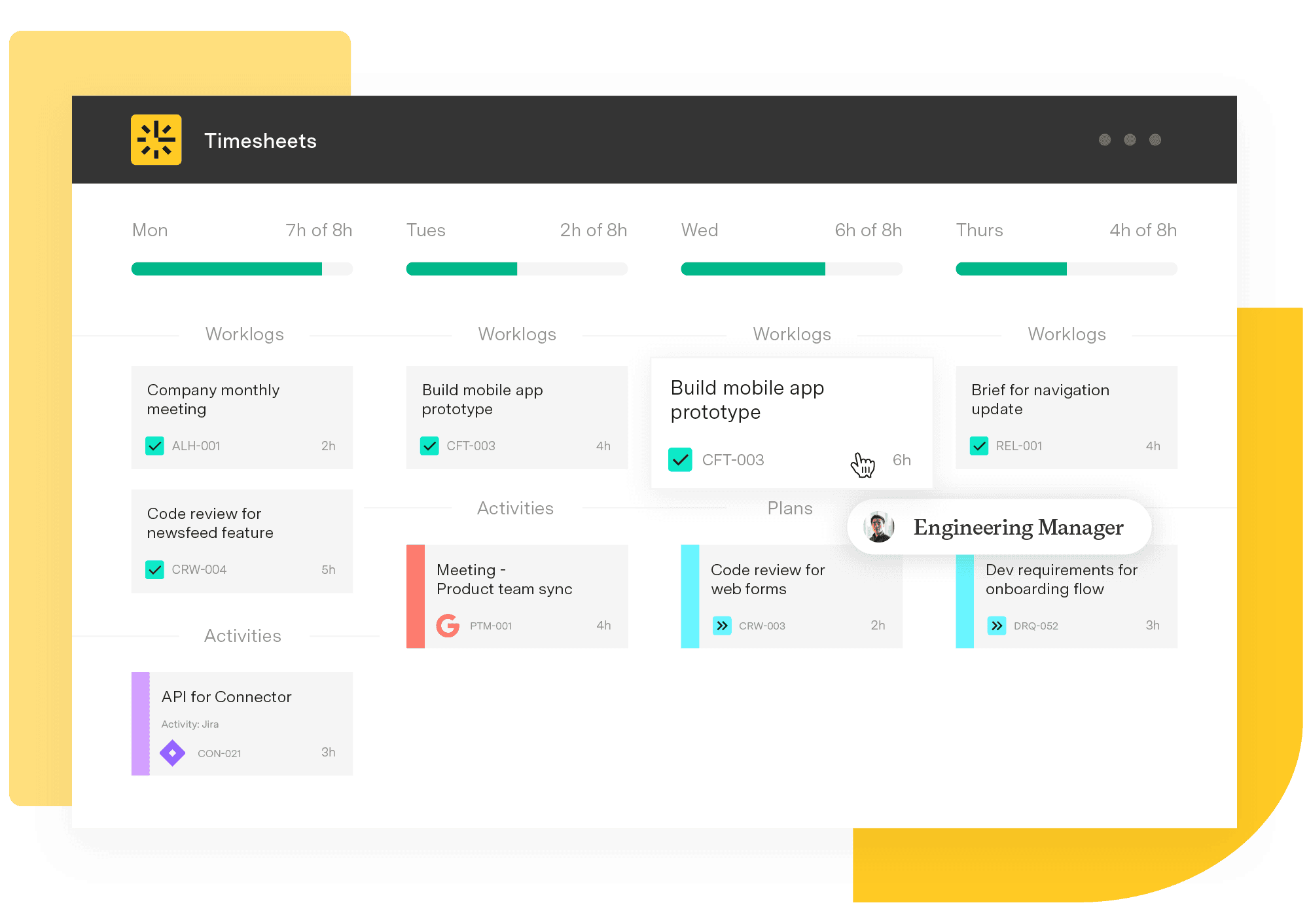

Timesheets – Supporting governance and success

With thousands of external contributors across the group, Timesheets plays a central role in billing and auditing work.

At OTP, external developers log all their hours in Timesheets. This process can sync up with other tools and calendar apps and get them logging time quickly, which OTP’s internal approvers can then validate using time logs and create reports for vendor billing in just a few clicks.

Papp also told Tempo about how OTP uses Timesheets data to monitor the delivery of the quarterly backlog. It gives them reliable data on whether colleagues were working on the tasks that were planned, and if they accurately assessed the scope of their tasks by comparing planned vs actual resource usage.

This has given OTP a solid foundation of data to improve all of their quarterly planning – so they can make decisions for the future confident that the data is in their corner.

“External users must log their work in Tempo – it’s non-negotiable. The reports are the foundation for most of our external vendor payments.” Gergo Papp, CoE Lead, OTP Bank Group

Why Tempo?

OTP’s decision to select Tempo as its strategic vendor was shaped by three core factors:

Enterprise-ready governance

Tempo stood apart in its ability to meet OTP’s security and compliance needs. Most competitors failed to meet the bar for DORA and contractual scrutiny.

“The Atlassian ecosystem is great because of the choice of app vendors, but for an enterprise financial business, it’s not tenable. We need a trusted partner – fully integrated with Jira – that can meet our compliance needs. Tempo delivers this.”

Gergo Papp, CoE Lead, OTP Bank Group

Scalable value

With thousands of Jira users and multiple subsidiaries, OTP needed pricing and architecture that scaled. Tempo’s Enterprise License Agreement (ELA) offered a cost-effective path forward, bundling solutions and simplifying procurement.

User adoption

Despite early learning curves, Tempo products have become deeply embedded in OTP’s ways of working.

“We love it. Users love it. Our agile coaches love it. Once teams understand Structure, they don’t want to go back.” Gergo Papp, CoE Lead, OTP Bank Group

The impact

Since implementing Tempo, OTP has:

✅ Reduced its Jira plugin count from 60+ to a curated, secure set

✅ Standardized enterprise planning across 10 subsidiaries

✅ Achieved DORA and GDPR compliance across its Atlassian stack

✅ Enabled full visibility from OKRs to stories, across hundreds of teams

✅ Improved vendor billing accuracy and audit-readiness

“Tempo helps us see everything – from the top of the org to the delivery floor. That’s real enterprise agility.” Gergo Papp, CoE Lead, OTP Bank Group

What’s next?

With Tempo’s tools in place, OTP is now focused on expanding rollout across new subsidiaries and deepening alignment between business goals and team execution.

As adoption grows, so does the bank’s ability to scale with confidence – driven by visibility, governance, and smarter planning.

Want to experience the same results? Try Structure, Timesheets, Gantt Charts, or Capacity Planner free for 30 days and see how Tempo can help your teams plan and deliver with clarity. Alternatively, book a demo with the team to discuss your requirements.